The US dollar is retreating and more so against the Japanese yen. This is an extension of the falls seen earlier in the week and they prove once again: what cannot go up must come down. The pair made a false break last week above the 114.50 level.

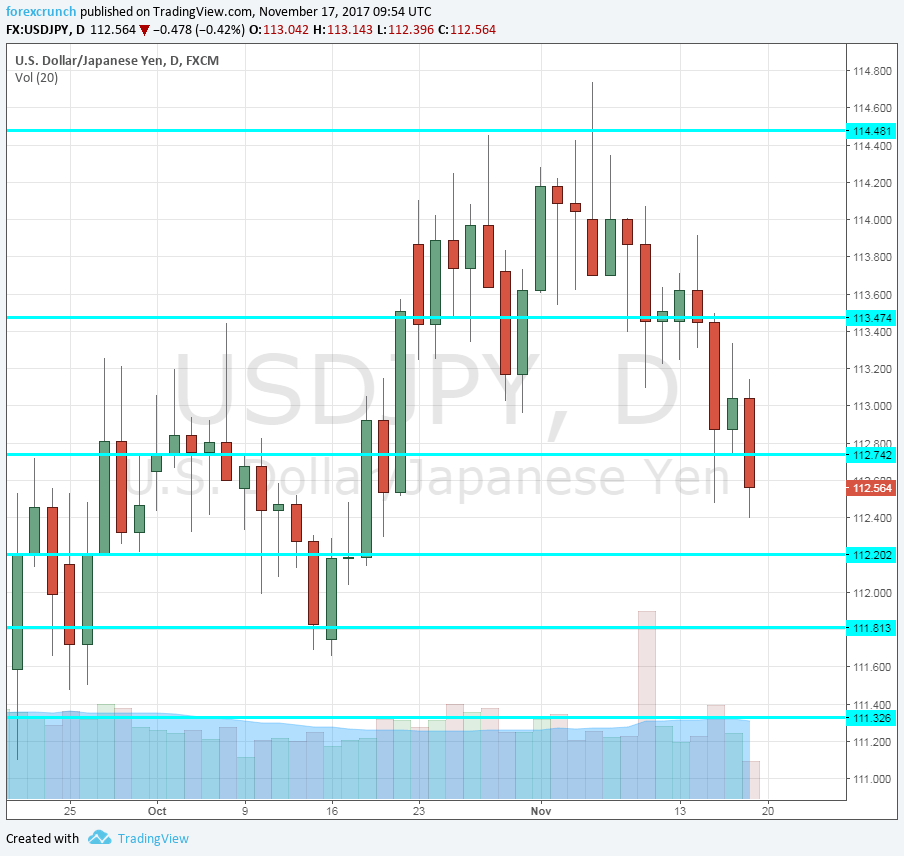

We are now at 112.55 after hitting a low of 112.39. Further support awaits at 112.20, followed by 111.80. Resistance awaits at 112.75 and then 113.50.

Why is the dollar falling? Here are four reasons three related to the greenback and one more related to the Japanese yen.

- Mueller dives deeper: The investigation about Russia’s interference in the US elections is deepening once again. Special counsel Robert Mueller has issued a subpoena to “over a dozen” officials in the Trump campaign. This had already happened in October but published now. The investigation is getting closer to the president and the dollar doesn’t like it.

- Tax cuts still in doubt: Thursday was a positive day for Republicans: they passed the tax cuts bill in the House where they command a wide majority. The panel in the Senate also advanced a bill to the full Senate. However, the bills are not identical. In addition, a majority in the Senate is not guaranteed. The longer the debate lasts, the longer the opposition grows. There is already one Senator opposed to the bill, and if two more express their rejection, it could fail.

- Negative rates?: The president of the San Francisco Fed, John Williams, said that negative rates are an option. They should be in the Fed’s toolbox. Negative rates have been enacted in Japan and in the euro-zone but seemed to be ruled out in the US. While the Fed is on course to raise rates once again, opening the door to diving deeper is yet another downer.

- North Korean ballistic missile submarine?: Reports are emerging that the rogue regime in North Korea is building an operational ballistic missile submarine in an “aggressive schedule”. This is of worry to the US and also to Japan, but the yen enjoys safe-haven flows, even if the danger is related to Japan.

More: USD: Stalled; Most Of Good News On US Tax Cuts Look Already Incorporated – Barclays

Here are the recent moves on the daily dollar/yen chart. We still have US building permits and housing starts later today.