- The USD/JPY pair is up for the fifth consecutive day, reaching 2016 high.

- Hawkish Fedspeak supports US Treasury yields and durable goods orders ahead of the PMI.

- Minutes from the Bank of Japan’s Kataoka meeting imply a bearish outlook for the yen.

- There could be a delay in final preparations due to grim news for Russia and Ukraine during Biden’s visit to Europe for the NATO summit.

The USD/JPY outlook gained 0.25% on the intraday, around 121.60 ahead of Thursday’s European session, extending the winning streak to five days.

The USD/JPY pair has been updating from a five-day uptrend since January 2016. Recently, USD/JPY bulls have been favored by the underlying strength in US Treasury yields. In addition, the Bank of Japan’s news is also supporting the bulls.

–Are you interested in learning more about STP brokers? Check our detailed guide-

Fed hawks and soaring yields

On Wednesday, the yield on the US 10-year Treasury fell from a three-year high by 2.2 basis points (bps). During the recent bond crash, the Fed’s hawkish speech boosted yields and favored dollar buyers. Recently, St. Louis Fed President James Bullard and Cleveland Fed President Loretta Mester endorsed negotiations for a Fed rate hike and quantitative tightening (QT) in May.

Dovish Bank of Japan

Meanwhile, the Bank of Japan (BOJ) is willing to expand its easy money policies in response to BOJ Board Member Goushi Kataoka’s comments regarding weakening JPY rates. A weak yen is good for the overall economy, says Kataoka of the Bank of Japan.

Russian saga: A cause of risk aversion

Market sentiment is also under pressure ahead of President Biden’s meeting with NATO allies in Europe due to the US’ willingness to impose additional sanctions on Russia. In addition, the willingness of Russian President Vladimir Putin to require ruble payments for oil sold to “unfriendly” countries and concerns about the Coronavirus in China and Europe have also strained sentiment.

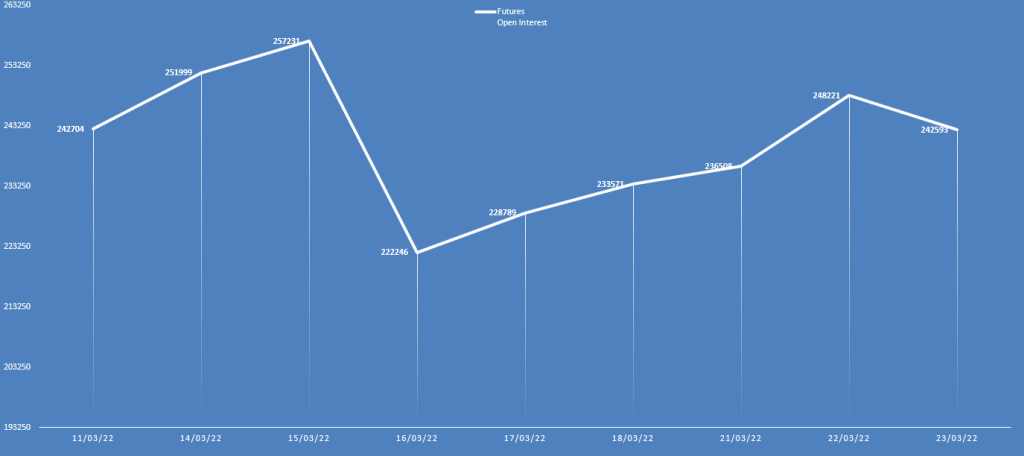

USD/JPY outlook via daily open interest

The USD/JPY price has been on the rise constantly. Meanwhile, the open interest has fallen by almost 6k contracts, indicating that the pair’s bullish outlook is weakened as the buyers have exited the market.

What’s next for the USD/JPY outlook?

In addition to Fedspeak speeches and risk catalysts, USD/JPY traders should also pay attention to Markit’s US PMI preview in March and durable goods orders in February.

The Markit Manufacturing PMI is likely to fall to 56.3 from 57.3 in previous reports, while the Markit services PMI may have fallen to 56.0 from 56.5. As a result, the US durable goods orders growth is expected to turn negative in February, with a forecast of -0.5% versus 1.6%.

–Are you interested in learning more about forex bonuses? Check our detailed guide-

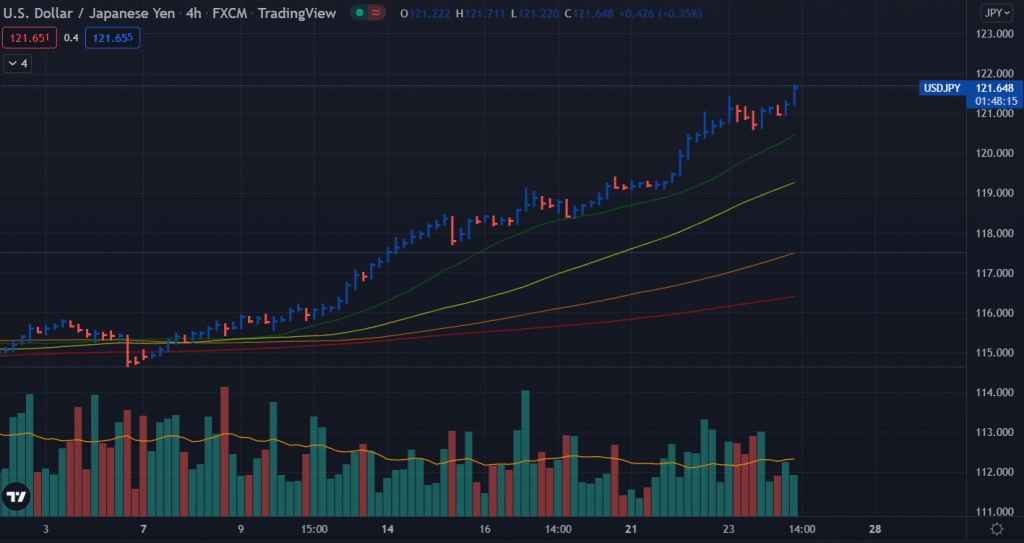

USD/JPY price technical outlook: Bulls to roar

The USD/JPY price is playing with the daily highs above 121.60 area. The pair has already marked a 72% average daily range so far. Meanwhile, the volume data also points at further gains. If the trend continues, the price may head towards 122.00 ahead of 122.50.

On the flip side, if the price finds a rejection around the current levels, we can observe a downside correction towards the 120.00 area.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money