- USD/JPY fades the previous day’s recovery from 107.00.

- Confirmation of bearish technical pattern highlights 200-HMA for the sellers.

- An upside break of the formation may aim for the monthly top.

- US-China tension, US President Trump’s comments on WHO and Aussie-Sino tussle are the latest catalysts.

Having failed to cross Monday’s top, USD/JPY drops to 107.38 during the pre-European session on Tuesday.

The pair seems to have recently pressured as headlines concerning the US-China tension and US President Donald Trump’s comments relating to the World Health Organization (WHO) put a fresh bid under the US dollar amid risk-off sentiment.

Also contributing to the risk aversion could be the Aussie-China tussle after the dragon nation levied 80% tariffs on the Australian barley.

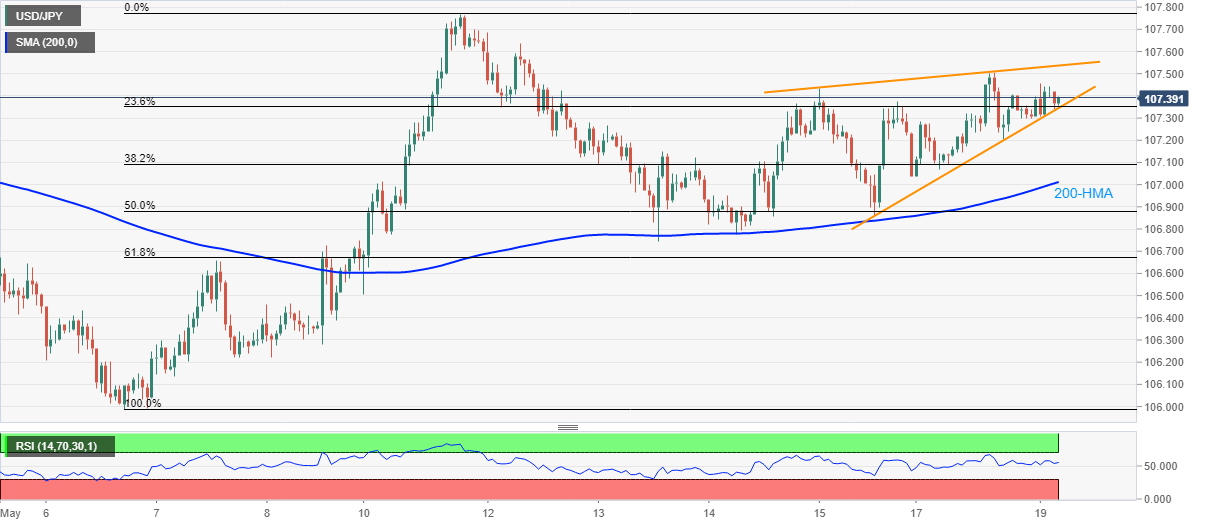

That said, the pair is yet to confirm a bearish formation to lure the sellers. In doing so, a decisive break below 107.30 becomes necessary to target a 200-HMA level of 107.00.

On the contrary, an upside break of the pattern’s resistance line, at 107.55 now, can escalate the previous day’s recovery moves towards the monthly top near 107.77.

USD/JPY hourly chart

Trend: Pullback expected