- USD/JPY bears are seeking a break of daily support and the 21-day sma.

- US dollar positioning should be monitored closely this week.

USD/JPY bears are seeking a meaningful correction, although positioning data should be eyed for prospects of longer net longs in the USD.

The last CFTC report showed that for the first time since early June 2020, speculators’ net positions had turned long USDs following a reduction in shorts in recent weeks.

The dollar is catching a safe-haven bid as well which has dented the yen’s appeal to some extent.

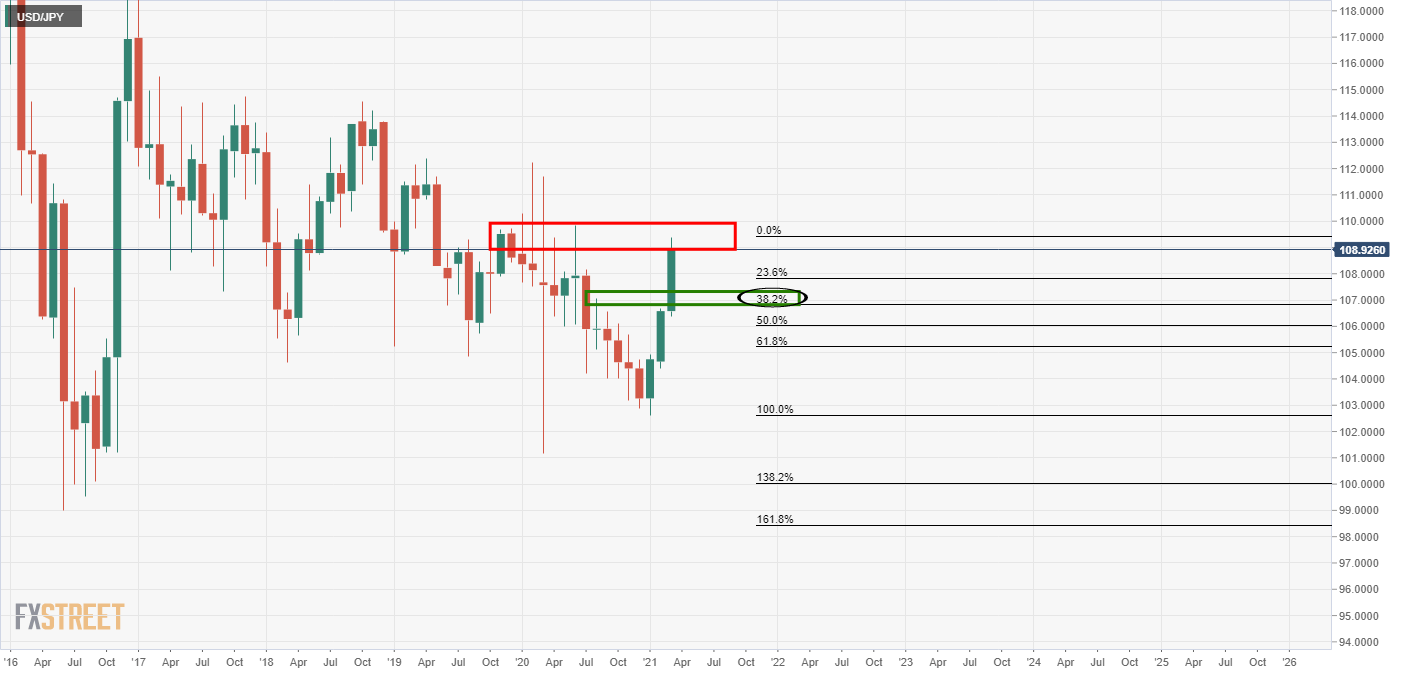

Meanwhile, the following top-down analysis illustrates that the price is in supply territory, so the focus in te spot market can be on the downside.

USD/JPY Monthly chart

The focus is on the 38.2% retracement zone where the price would be expected to stablise.

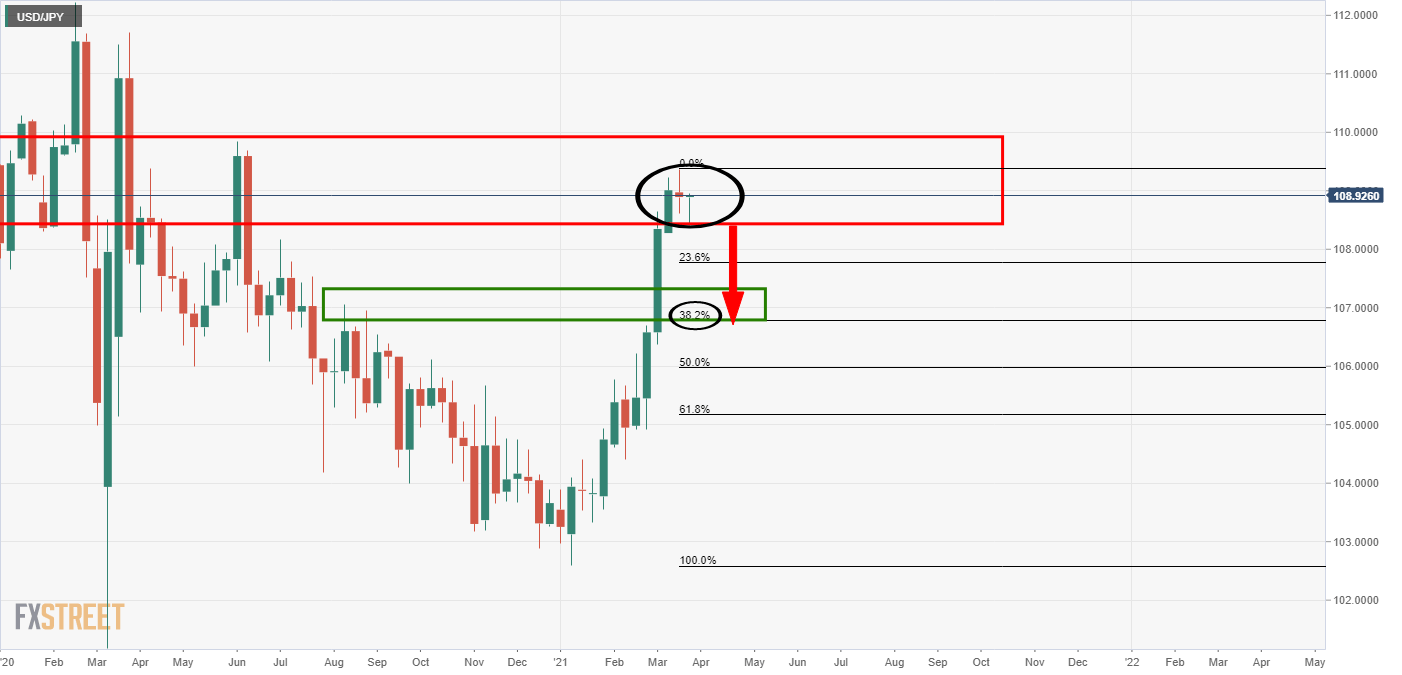

USD/JPY weekly chart

Bears will want to see a bearish weekly closing candle following the bearish doji candle to confirm a downside corrective bias.

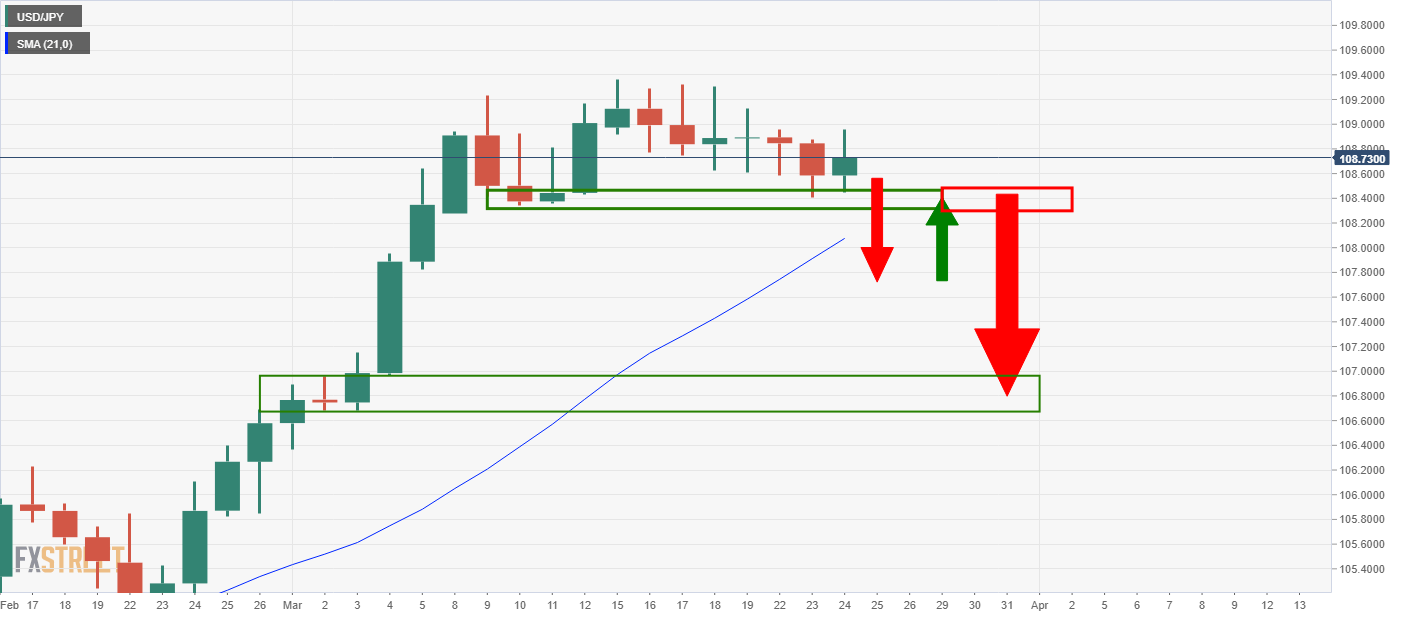

USD/JPY daily chart

Bears will be on the lookout for a break of the support structure and the 21-day SMA.