- USD/JPY trims early-Asian gains amid cautious sentiment.

- Keeps downside break of one-month-old horizontal support amid bearish MACD.

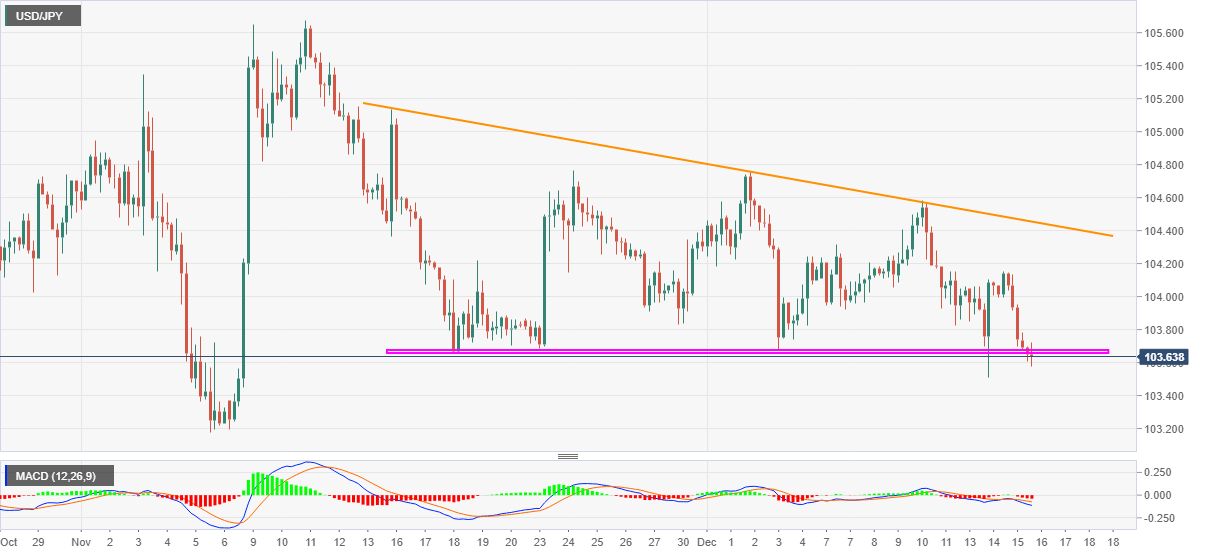

- Descending trend line since mid-November becomes the key resistance.

USD/JPY stays below the monthly descending triangle while recently declining to 103.65 during early Wednesday. The yen pair seems to wait for the key US coronavirus (COVID-19) stimulus updates for fresh direction.

Read: S&P 500 Futures print mild losses with eyes on US stimulus, Fed decision

Technically, the pair’s sustained downside break of short-term support joins bearish MACD to keep the sellers hopeful. In doing so, November’s low near 103.15 and the 103.00 round-figure are on their radars.

In a case USD/JPY bears remain dominant past-103.00, the return of March bottom near 101.20 can’t be ruled out.

Meanwhile, corrective pullback beyond the immediate resistance line, previous support, around 103.65/70, can recall the 104.00 round-figure on the chart.

However, any further upside will depend upon how well the USD/JPY buyers manage to defy triangle resistance, at 104.45 now.

USD/JPY four-hour chart

Trend: Bearish