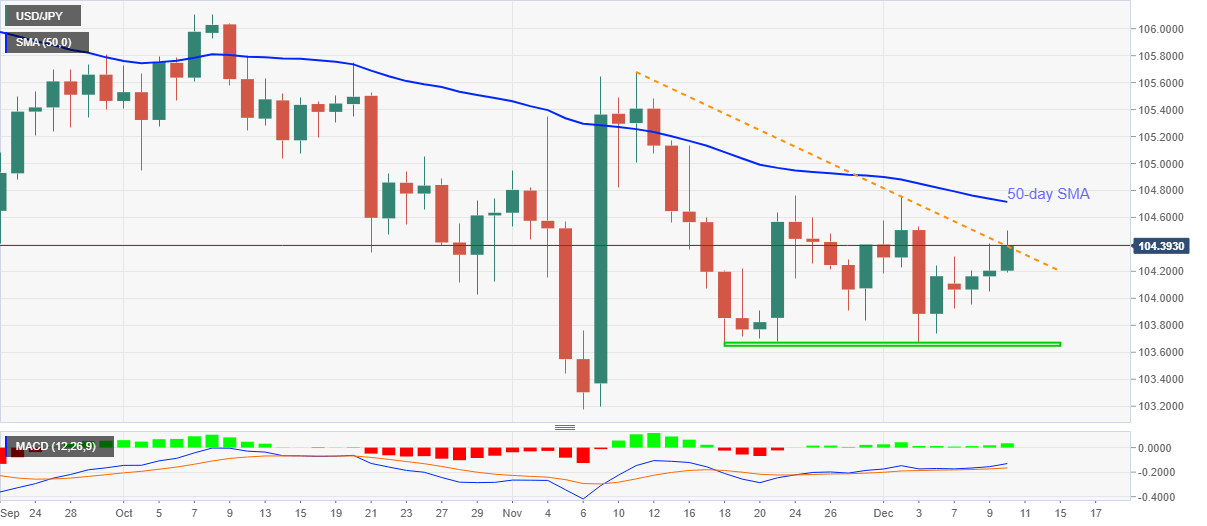

- USD/JPY eases from intraday high, keeps trend line breakout.

- Bullish MACD, sustained break of previous resistance eyes 50-day SMA.

- Three-week-old horizontal support restricts short-term downside.

USD/JPY cools down from a weekly high of 104.50 to 104.40, still up 0.18% intraday, during the pre-European open trading on Thursday. The pair recently pierced a downward sloping trend line from November 11 while printing a three-day winning streak.

Not only the upside break of the previous resistance line but bullish MACD also directs USD/JPY buyers toward the 50-day SMA level of 104.71.

It should, however, be noted that the monthly top near 104.75 will add filters to the quote’s upside past-50-day SMA.

Meanwhile, failures to keep the trend line breakout, at 104.38 now, on a daily closing basis can recall the 104.00 threshold back to the charts.

Though, multiple lows marked since November 18, near 103.70/65, will be a tough nut to crack for USD/JPY sellers past-104.00.

USD/JPY daily chart

Trend: Further upside expected