- USD/JPY gained traction for the fifth straight day and shot to fresh multi-month tops.

- RSI closer to the overbought zone warrants caution before placing fresh bullish bets.

- Dips towards the 106.00 round-figure mark might still be seen as a buying opportunity.

The USD/JPY pair edged higher for the fifth consecutive session on Monday and climbed to fresh six-month tops, around the 106.75 region during the first half of the European session.

A fresh leg up in the equity markets undermined the safe-haven Japanese yen. This, along with renewed US dollar buying, provided an additional boost. However, a mixed performance in the US bond market kept a lid on any further gains for the USD/JPY pair.

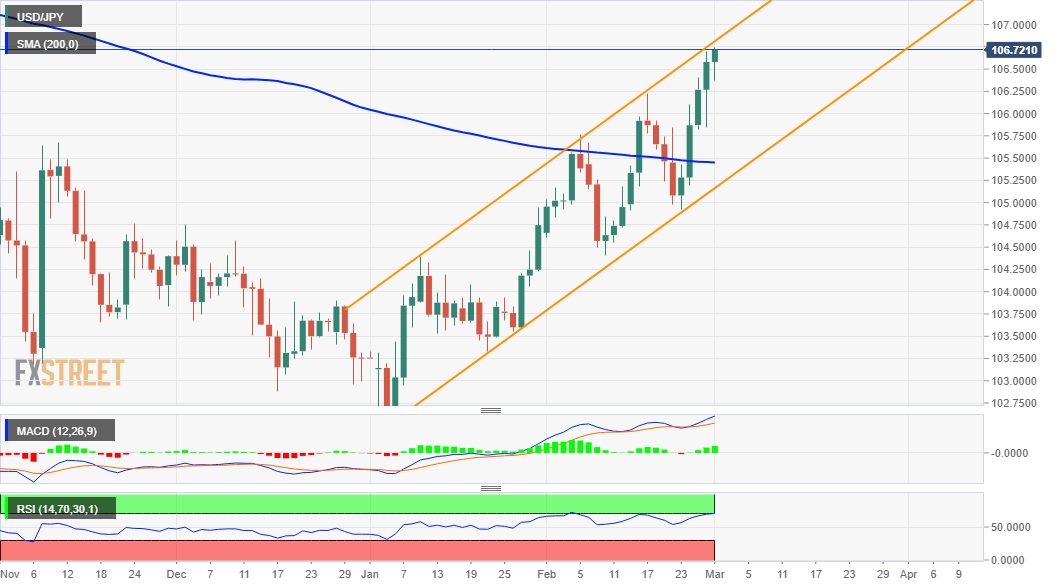

Looking at the technical picture, the pair has been trending higher along an upward sloping channel over the past two months or so. The set-up points to a well-established short-term bullish trend and supports prospects for a further appreciating move.

Meanwhile, RSI on the daily chart has moved on the verge of breaking into the overbought territory and warrants some caution for bulls. Hence, any subsequent positive move is likely to remain capped near the trend-channel hurdle, just ahead of the 107.00 mark.

That said, a sustained breakthrough will mark a fresh bullish breakout and open the room for an extension of the ongoing upward trajectory. The USD/JPY pair might then aim to test the next relevant resistance near the 107.45-50 supply zone.

On the flip side, the daily swing lows, around the 106.35 region now seems to protect the immediate downside. This is followed by support near the 106.00 round-figure mark and the very important 200-day SMA, currently around the 105.45 region.

The latter coincides with the lower boundary of the trend channel, which if broken decisively will negate any near-term bullish bias. The subsequent slide would turn the USD/JPY pair vulnerable to break below the key 105.00 psychological mark.

USD/JPY daily chart

Technical levels to watch