- USD/JPY is bouncing sharply from the 2020 lows as US stocks are recovering.

- USD/JPY gained a massive 3.7% on an intraday basis.

- UoM Consumer Sentiment at 95.9, shrugs off coronavirus concerns.

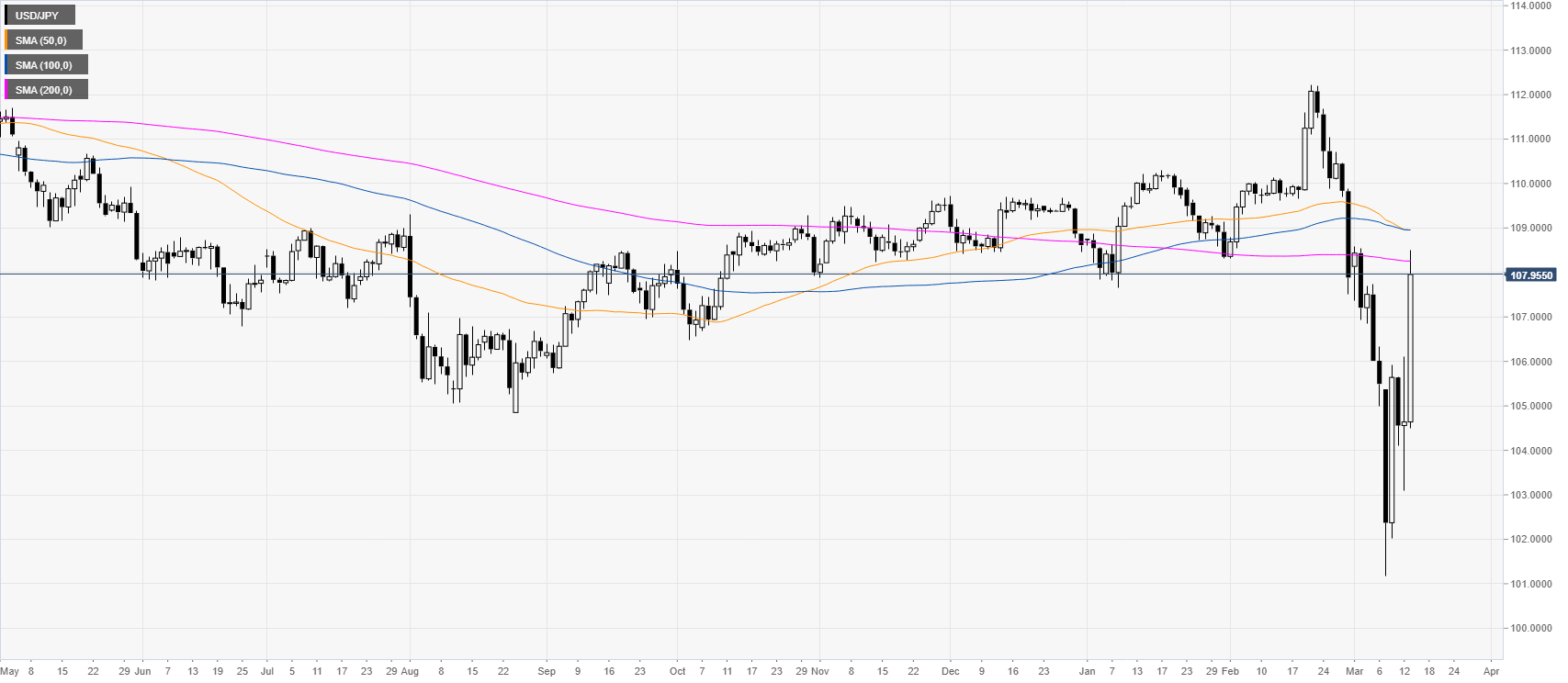

USD/JPY daily chart

USD/JPY is reversing up from three-year lows while trading below the simple moving averages (SMAs) as the US equity markets are bouncing after one of the worst sessions since 1987 this Thursday. The Coronavirus narrative is leading to hysteria and panic worldwide in an unprecedented alarmist message from mass media for a case of pandemic flu. Additionally, this Friday, the University of Michigan’s initial gauge of consumer confidence came in at 95.9 above the 95 level.

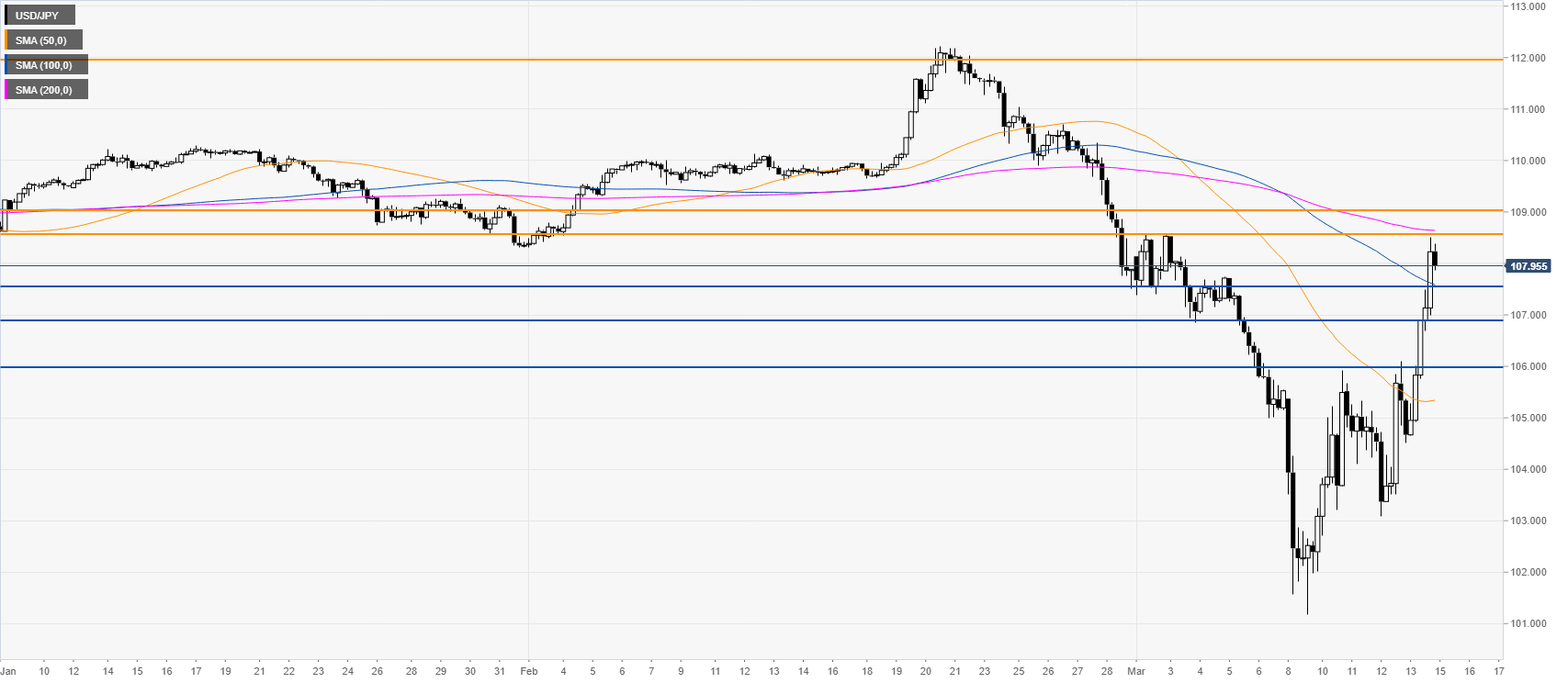

USD/JPY four-hour chart

USD/JPY is challenging the 108.60/109.00 resistance zone and the 200 SMA on the four-hour chart. The spot is spiking to the upside and a break beyond the above-mentioned level could expose the 112.00 level near the last swing high. Support can be seen near the 107.60, 107.00 and 106.00 levels.

Resistance: 108.60, 109.00, 112.00

Support: 107.57, 107.00, 106.00

Additional key levels