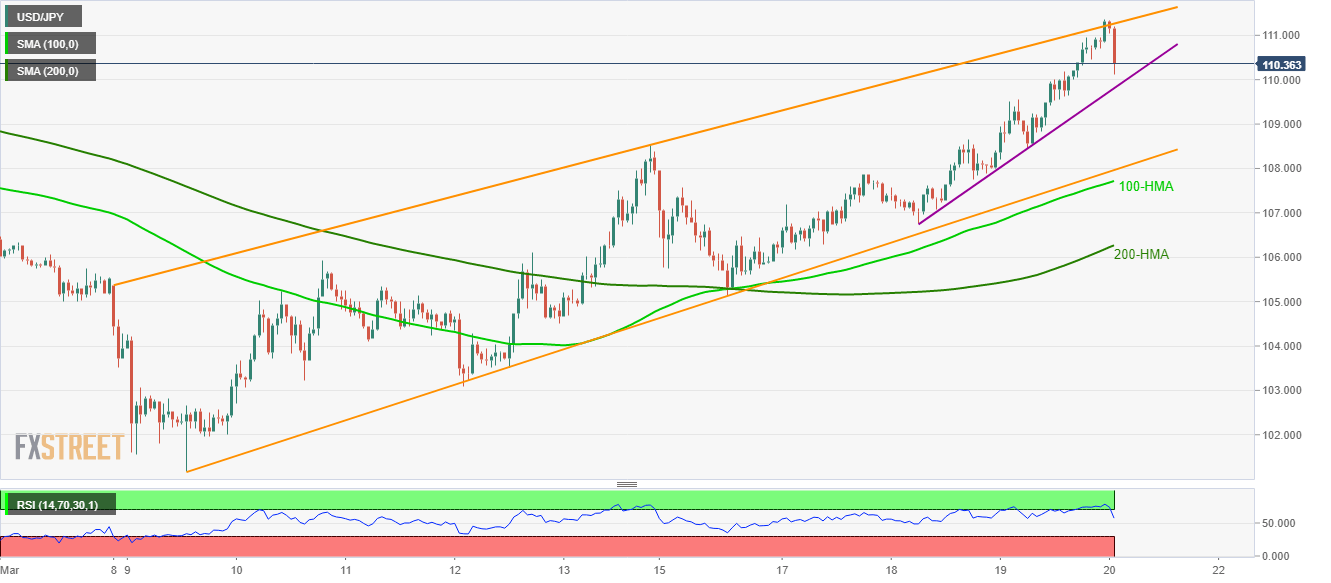

- USD/JPY pulls back from three-week high amid overbought RSI.

- The two-day-old support line can offer immediate rest, a bit broader trend line and 100-HMA will be the key afterward.

- Bulls can target February top during the fresh run-up.

Following its failure to cross a nine-day-old resistance line, USD/JPY drops from the monthly high to 110.22, down 0.55%, amid Friday’s Asian session.

The pair currently aims to revisit the short-term support line, at 109.80, as the RSI’s drop from overbought area favors further pullback.

However, an upward sloping trend line since March 09, at 107.90, followed by 100-Hour Simple Moving Average (HMA) near 107.70, can challenge the bears afterward.

Alternatively, buyers will aim for February month high near 112.25 during the fresh rise beyond 111.40.

USD/JPY hourly chart

Trend: Pullback expected