- USD/JPY holds in bullish territory into the Fed.

- Bulls eye an upside extension following the event’s volatility.

Further to the prior analysis, USD/JPY Price Analysis: Bulls throwing in the towel? 103.50 is the big test, bulls have taken the reins and broken the dynamic resistance which opens the doors for an upside continuation.

However, it is rare that a market will break the structure and keep running on the first test of the seller’s commitments.

Instead, a battle of control would be expected between the recent highs and buyer’s commitments within the recent ranges.

That being said, anything can happen around the Federal Reserve’s interest rate decision.

Watch the Fed live

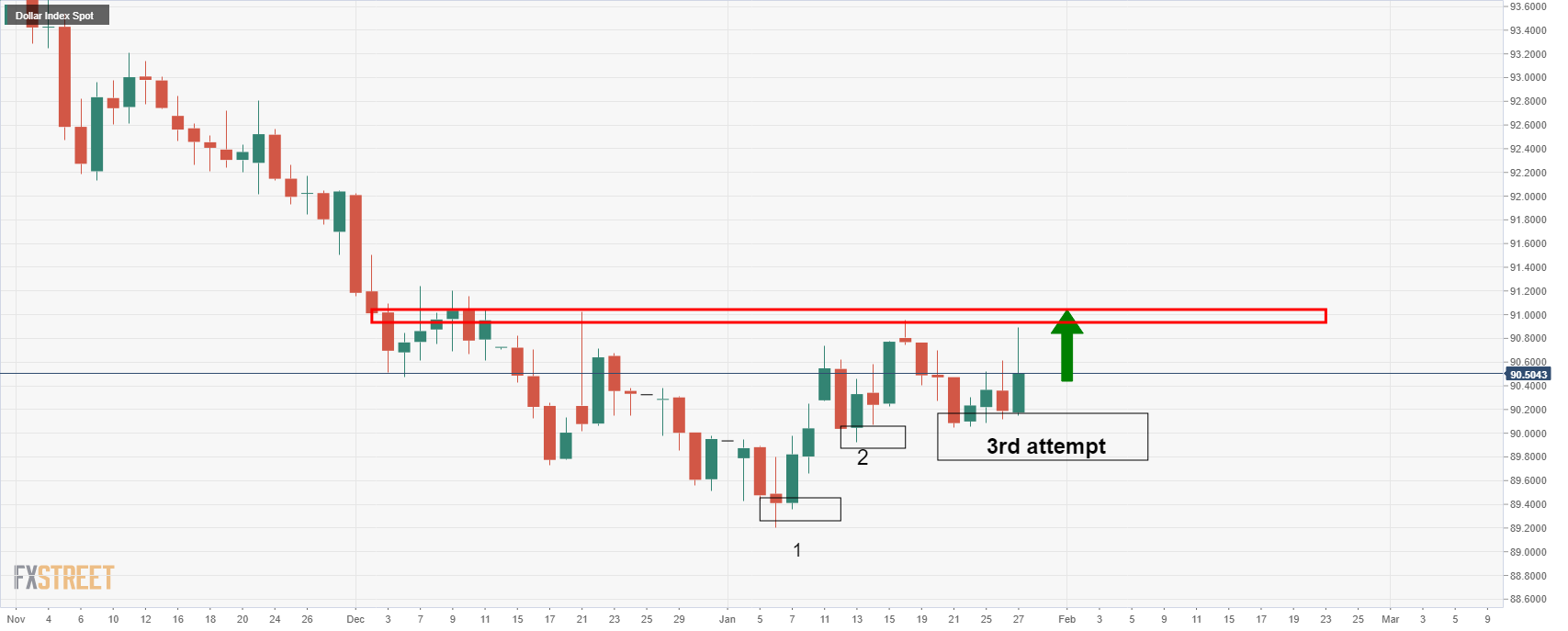

Should there not be a downplay in the taper theme, then the US dollar could well find a second or third wind even, as it continues to correct from the cycle lows, targeting a break of 91 in the DXY:

DXY daily chart

As for the yen, the play around the Fed, from a swing trading perspective and a deep stop loss, could be to buy dips.

From a 4-hour perspective, the price has rallied beyond resistance in an over extended W-formation.

A downside correction would be expected to reach at least a 38.2% Fibonacci retracement of the 4-hour bullish impulse.

However, a 50% mean reversion has a confluence with structure prior highs.

If there is significant volatility of a 20 pip move to the downside, then a stop loss below the 78.6% Fibo of the prior bullish impulse as well as the 4-hour structure could well safeguard a position executed during the volatility.

Example set-up as follows:

Bulls can target a -0.272% Fibonacci of the daily corrective range for a 1:3 risk to reward high probability trade setup.