- USD/JPY bears repeat the pullback move from 107.90.

- The greenback bears the burden of US President Donald Trump’s tenderness on China, riots in America.

- Highs marked since April 16 add to the upside barriers.

- 107.40, 61.8% Fibonacci retracement act as immediate supports.

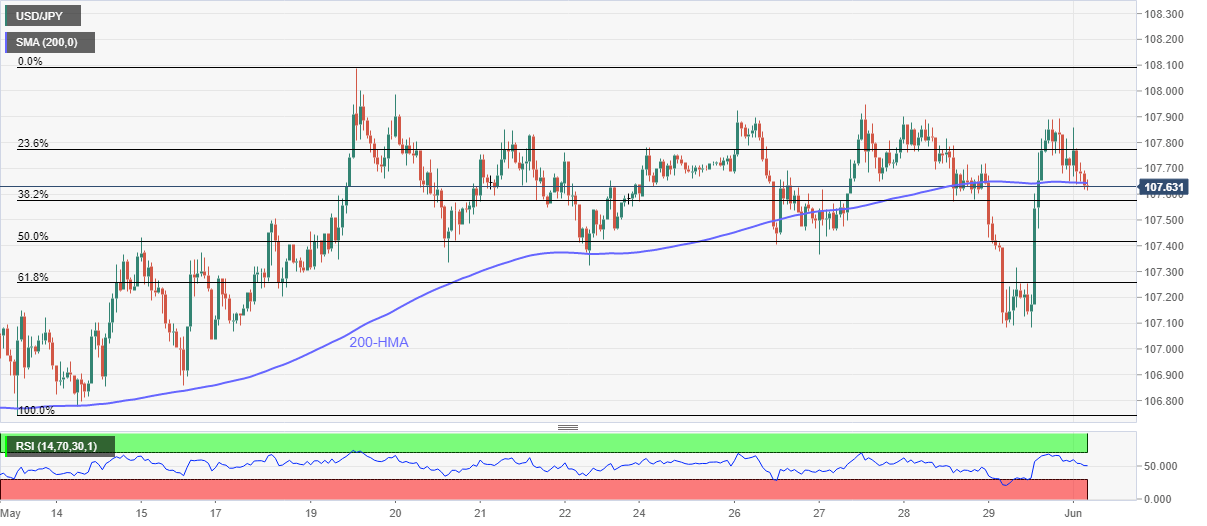

USD/JPY drops to 107.61, down 0.18% on a day, during the pre-European session on Monday. The pair recently declines below 200-HMA as the US dollar index (DXY) stays pressured near 11-week low following President Trump’s no sanctions on China while also taking clues from riots in several states of the world’s latest economy.

Read: Trump tenderness, China’s Caixin, boost Asia

Technically, the pair’s declines below the key HMA drag it further down toward 107.40 immediate support.

However, 61.8% Fibonacci retracement level of May 13-19 upside around 107.25 could challenge the bears then after, if not then the sub-107.00 area could return to the charts.

On the contrary, an upside clearance above the recent high around 107.90 isn’t a convincing sign for the pair’s run-up as multiple highs marked since April 16 around 108.10 act as the strong resistance.

In a case where the bulls manage to cross 108.10, which is less likely considering the USD weakness, April month’s high near 109.40 will lure the buyers.

USD/JPY hourly chart

Trend: Bearish