Dollar/yen traded slightly lower in the final week of 2017, sliding together with the general weakness of the US dollar. However, it never fell out of range. Will we see fireworks in 2018? The year begins with the US Non-Farm Payrolls, and that is a promising start.

USD/JPY fundamental movers

End-of-year dollar sell-off

The US dollar was on the back foot. It was an extension of the “sell the fact” reaction to the signing of the tax bill and also some portfolio adjustment. The yen was not the big winner, but it also took advantage of this.

US data didn’t help: CB Consumer confidence slipped to 122.1 points, jobless claims remained unchanged at 245K, and the trade balance deficit remained wide. Only pending home sales stood out with a small rise of 0.2%.

In Japan, we learned that industrial output rose by 0.6%, better than expected. Retail sales leaped by 2.2%, easily exceeding expectations.

NFP, FOMC meeting minutes, and a return from the vacation

The new year begins with a bang: the Non-Farm Payrolls receive a nearly full buildup (except the ISM Non-Manufacturing PMI which is released afterward). In addition, the Fed minutes may reveal if any additional members opposed the rate hike in addition to the two voters that dissented. If low inflation persists, it could hurt the dollar.

See all the main events in the Forex Weekly Outlook

Key news updates for USD/JPY

[do action=”autoupdate” tag=”USDJPYUpdate”/]USD/JPY Technical Analysis

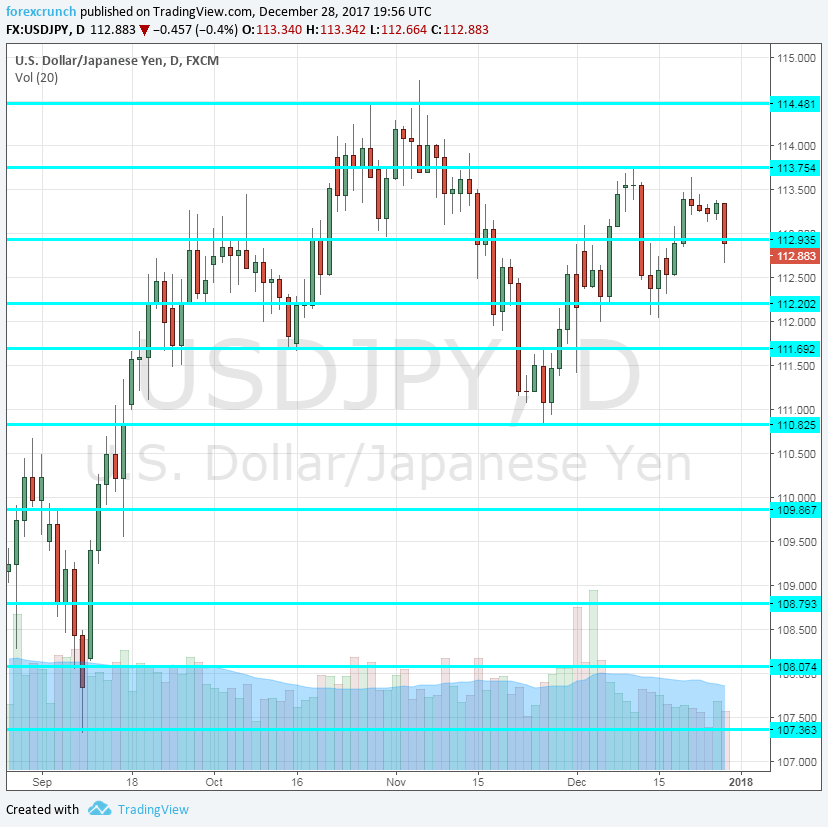

115.35 is an old line that served as support when the pair traded on higher ground. 114.50 is the cycle high last seen in early July. The pair got close to that level.

113.70 was a separator of ranges in June and a line of resistance in December. It caps the range. 112.90 served as support in December and is a pivotal line in the range.

112.20 used to be important in the past. It is closely followed by 111.70, which provided support back in October. The round level of 111 worked as a cushion to the pair in November.

Looking down, 110.70 was a separator of ranges in June and remains important. 109.60 was a gap line in late April, a gap that was never closed.

In June, the pair found support several times at 109.10 and this also works as support. Further below, the cycle low of 108.10 is of high importance.

USD/JPY Daily Chart

USD/JPY Sentiment

I am bearish on USD/JPY

The greenback may extend its falls into the new year, and USD/JPY has some catching up to do. If wages remain stuck at 2.5% y/y in the NFP report, it could weigh.

Our latest podcast is titled A December to remember for EUR/USD

Further reading:

- EUR/USD forecast – for everything related to the euro.

- GBP/USD forecast – Pound/dollar projections

- AUD/USD forecast – analysis for the Aussie dollar.

- USD/CAD forecast – Canadian dollar predictions

Safe trading!