- USD/JPY grinds lower and retreats from earlier peaks.

- Lower US yields put the recent upside to the test.

- US NFP will take centre stage later in the NA session.

The Japanese currency appears mildly bid and drags USD/JPY to the mid-110.00s at the end of the week amidst marginal trading conditions due to the Good Friday holiday in the majority of global markets.

USD/JPY looks to Payrolls

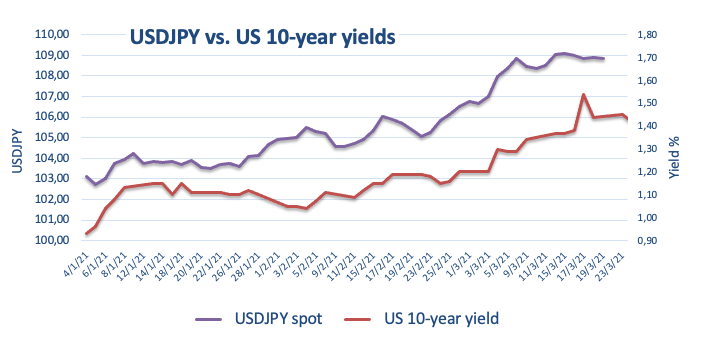

Following new peaks in levels just shy of the 111.00 mark (Wednesday), USD/JPY has triggered a tepid move lower mainly on the back of the corrective downside in yields in the US bond markets.

Indeed, yields of the key US 10-year note deflated to the 1.67% region on Thursday after hitting levels last seen over a year ago near 1.80% earlier in the week.

The yearly rally in the pair remains sustained by the recovery in US yields and the US economy outperformance narrative in the wake f the coronavirus pandemic.

In the data space, the BoJ informed that the Monetary Base expanded 20.8% on a yearly basis in April.

In the US data space, all the looks will be upon the release of the Nonfarm Payrolls for the month of March with consensus expecting the US economy to have created nearly 650K jobs and the unemployment rate is seen at 6.0%.

What to look for around JPY

The 4-month upside in USD/JPY stays largely unabated so far, extending the bounce off January’s lows in the vicinity of 102.50. The pair’s bull run remains mainly bolstered by the improved sentiment in US yields, which in turn appears underpinned by higher inflation expectations in the US. Furthermore, the mega-loose stance from the BoJ – which is seen in place for the foreseeable future – also collaborates with the softer yen, while speculative net longs in the safe haven have been scaled back strongly in past weeks.

USD/JPY levels to consider

As of writing the pair is losing 0.05% at 110.53 and faces the next support at 109.36 (weekly high Mar.15) seconded by 108.40 (low Mar.23) and then 106.97 (5-day SMA). On the upside, a surpass of 110.96 (2021 high Mar.31) would aim to 111.71 (monthly high Mar.24 2020) and finally 112.22 (2020 high Feb.20).