- The Dollar-Yen pairing sees bids going to the US Dollar ahead of Wednesday’s data measures.

- Safe havens remain a popular choice for market participants as trade angst and Turkey worries rule headlines.

The USD/JPY is trading into 111.30 in early Wednesday action as the US Dollar pushes upwards against the safe-haven Yen as broader markets continue to let go of last week’s risk-off plunge on Turkish contagion fears.

The Greenback has been grinding higher against the JPY in the early week with little economic data for both the US and Japanese economies, but Wednesday will be seeing m/m US Retail Sales (excluding autos) for July at 12:30 GMT which are forecast to tick down slightly to 0.3% from the previous reading of 0.4%.

On the Yen side, late Wednesday will be seeing Japan’s Trade Balance figures at 23:50 GMT, and Japan is expected to see a sharp contraction in the Merchandise Trade Balance for July (forecast ¥-50.0 billion, last ¥720.0 billion) as Japanese markets brace for a rapid expansion of Imports, forecast to jump from 2.6% to 14.4%.

The US Dollar is seeing some pickup against the Yen in market tensions that are by and large a result of the US administration’s hostile trade policies, with a still-brewing US-China trade war on the cards as well as a rapid escalation of tariffs against Turkey, Canada, and most of the US’ other major trading partners. Despite the boost the Greenback is seeing, the USD/JPY still remains off of July’s highs, and the major pair is seeing a minor hesitation in the overall bullish trend.

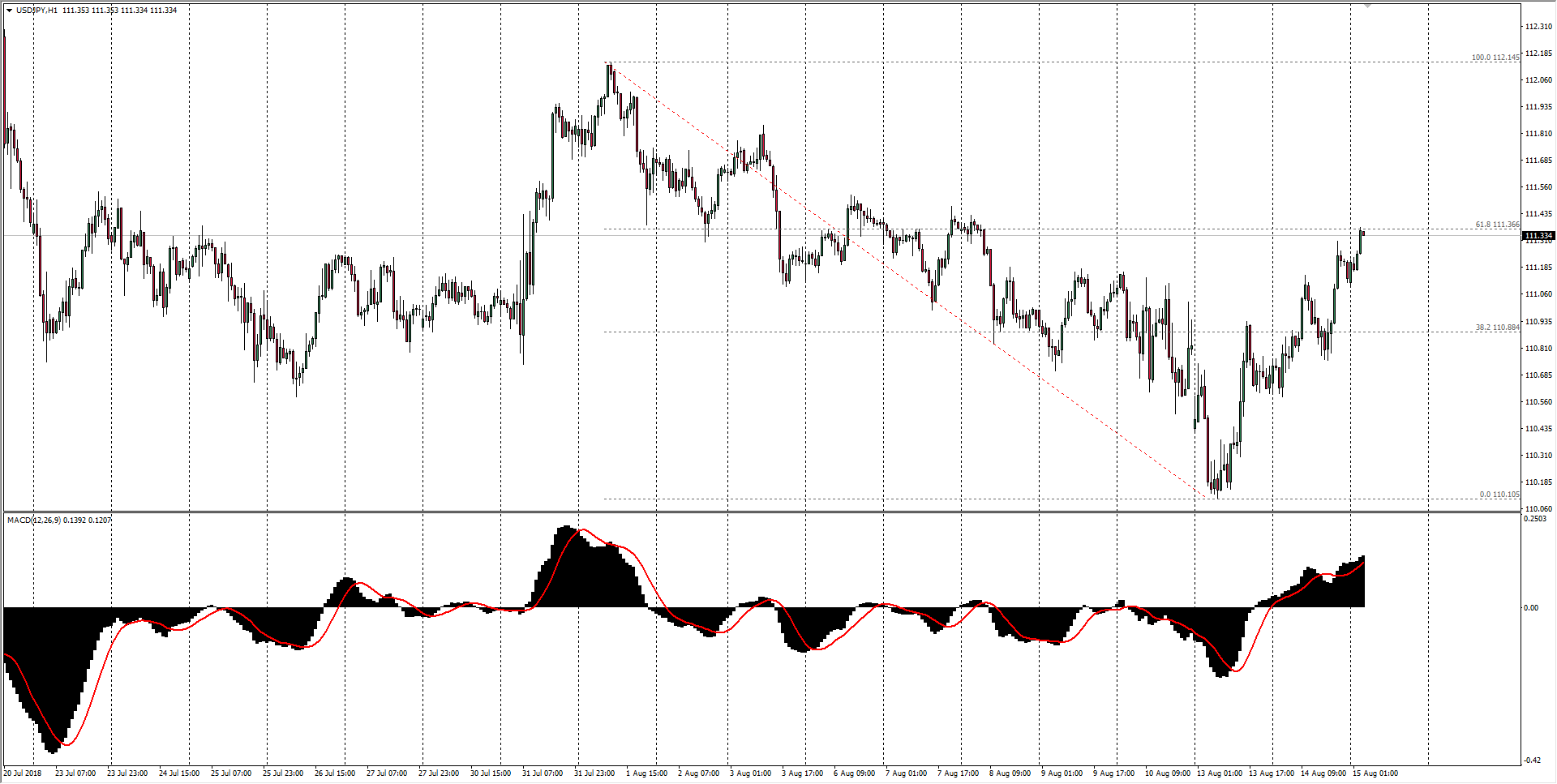

USD/JPY Technical Analysis

As the USD continues to claw back medium-term losses against the JPY, Turkish contagion concerns and the US-China trade faceoff are remaining close to the surface, keeping broader markets prone to rapid flights into safe havens. Technical indicators for the USD/JPY are beginning to push into overbought territory, warning of the potential for a pullback occurring somewhere above the 111.00 handle.

USD/JPY Chart, 1-Hour

| Spot rate: | 111.33 |

| Relative change: | 0.10% |

| High: | 111.37 |

| Low: | 111.10 |

| Trend: | Bullish |

| Support 1: | 111.00 (major technical level) |

| Support 2: | 110.58 (previous day low) |

| Support 3: | 110.10 (current week low) |

| Resistance 1: | 111.37 (61.8% Fibo retracement level; current day high) |

| Resistance 2: | 112.14 (two-week high) |

| Resistance 3: | 112.44 (R3 weekly pivot) |