“¢ USD remains supported by the overnight hawkish comment by Fed’s Powell.

“¢ Easing US-China trade tensions further weigh on JPY’s safe-haven appeal.

“¢ Overbought readings prompt profit-taking, albeit dips are likely to get bought into.

The USD/JPY pair now seems to have entered a bullish consolidation phase and was seen oscillating in a narrow trading range, just above mid-112.00s.

The pair continued with its bullish trajectory and was supported by easing US-China trade tensions, following a Bloomberg report that the world’s two biggest economies are willing to resume trade talks and resolve their differences. The report prompted a fresh wave of global risk-on trade and was eventually seen weighing on the Japanese Yen’s safe-haven appeal.

This coupled with a modest US Dollar uptick, underpinned by overnight hawkish comments by the Fed Chair Jerome Powell, provided an additional boost and lifted the pair to a fresh six-month high level of 112.77 during the Asian session on Friday.

During a radio interview on Thursday, Fed’s Powell said that the US economy is in a “good place” at the moment with low unemployment and inflation rising toward the central bank’s optimal range, reaffirming prospects for at least two more interest-rate hikes by the end of this year.

Technical Analysis

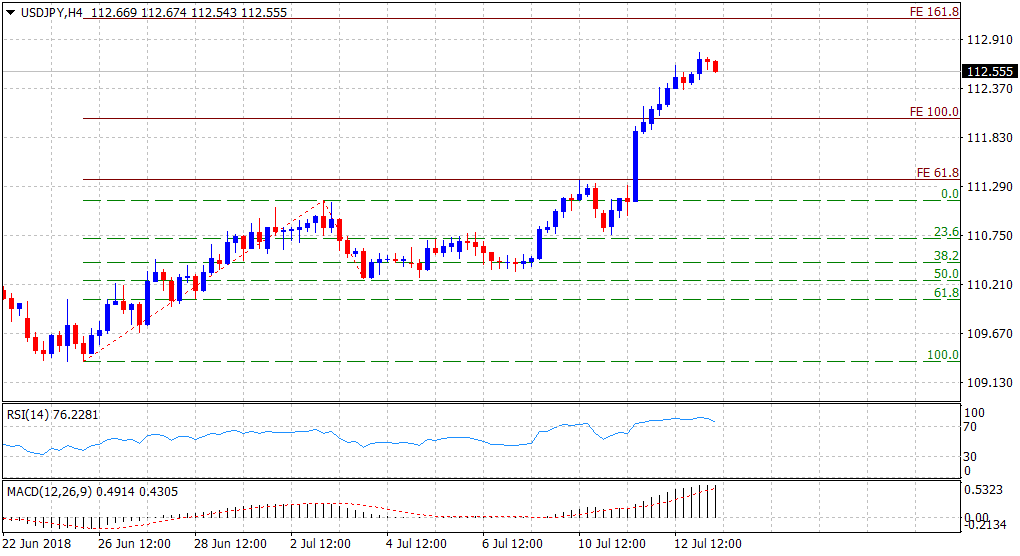

From a technical perspective, near-term overbought conditions could be one of the key factors prompting some profit-taking, especially after this week’s strong upsurge of 140-pips over the past five trading session.

However, considering the latest bullish breakthrough the 111.40 key hurdle (61.8% Fibonacci expansion level of the 109.37-111.14 up-move and subsequent retracement) and follow-through momentum beyond the 112.00 handle, any meaningful dip might now be seen as an opportunity to initiate fresh long positions.

Spot rate: 112.56

Daily High: 112.77

Daily Low: 112.47

Trend: Bullish

Resistance

R1: 112.83 (R1 daily pivot-point)

R2: 113.00 (round figure mark)

R3: 113.39 (YTD tops set early Jan.)

Support

S1: 112.47 (current day swing low)

S2: 112.09 (S1 daily pivot-point)

S3: 111.70 (20-period SMA H4)