Dollar/yen began the last week of Fiscal Year 2017 by dipping to the lows but quickly recovered. Is this a change of course or only an adjustment for temporary purposes? The upcoming week features the Non-Farm Payrolls and a FY in Japan.

USD/JPY fundamental movers

Strong US GDP, last-minute flows

The US economy grew at an annualized pace of 2.9% in Q4 2017, better than expected and an upgrade to the previous estimate. Alongside an expected rise in the Core PCE, the USD received its positive dose of data. Trade worries also petered out as China and the US gave signs that they are trying to find a solution to the issues.

While the political scandal is brewing in Japan around the Morimoto deal, the meeting between North Korea’s Kim and China’s Xi helped improve the atmosphere. Kim will meet his South Korean counterpart Moon on April 27th.

End-of-month, quarter and Fiscal Year flows also contributed to price action and the pair corrected some of its losses.

The buildup to the Non-Farm Payrolls, Tankan surveys

The first week of Fiscal Year 2018 begins in Japan with the Tankan surveys. These fresh figures are expected to show a small upgrade, perhaps strengthening the yen, even though Japanese data rarely moves the currency.

Later on, it is all about the Non-Farm Payrolls. The ISM Manufacturing PMI on Monday serves as the first hint, followed by the ADP NFP and the ISM Non-Manufacturing PMI on Wednesday. Friday’s NFP remains centered around wages. After a disappointing deceleration to 2.6% in February, a small acceleration to 2.7% is on the cards. Job growth is expected to be slower at around 200K, but this comes after a superb rise of 313K back in February.

Last but not least, Fed Chair Jerome Powell will speak late on Friday about the economic outlook and may respond to the jobs report.

See all the main events in the Forex Weekly Outlook

Key news updates for USD/JPY

[do action=”autoupdate” tag=”USDJPYUpdate”/]USD/JPY Technical Analysis

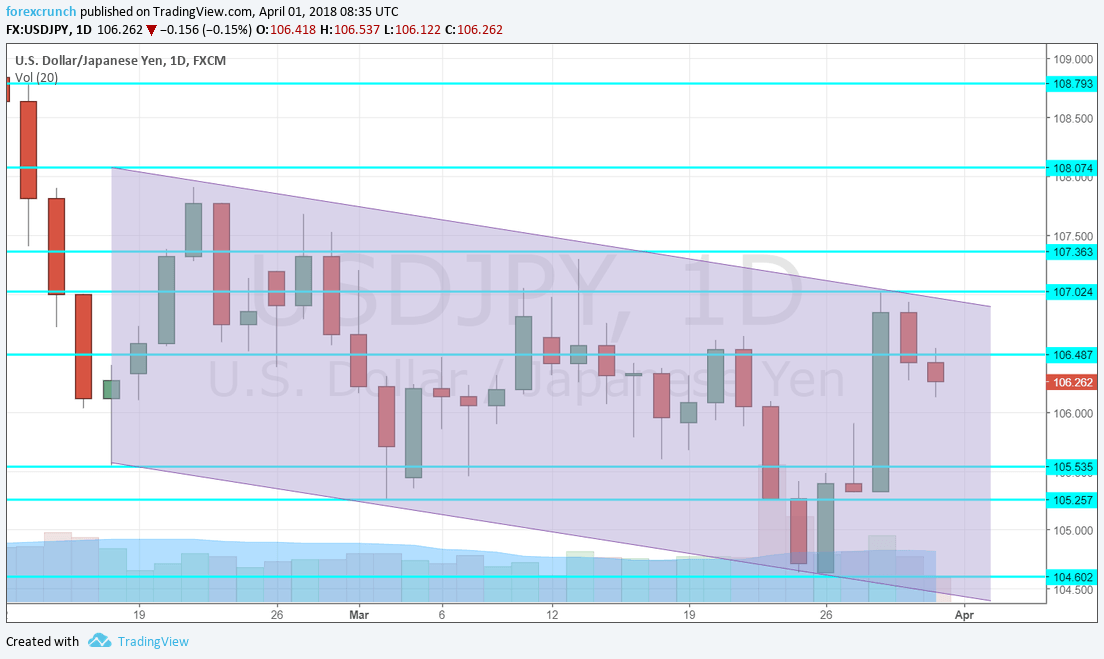

We start from 110.70 that was a separator of ranges in June and remains important. The round number of 110 serves as a psychological level.

109 was a pivotal line within the range. 108.30 was the low seen in late January. Even lower, we find 107.30 that was the low in September and now turns into resistance after capping the pair in late March.

106.50 was a resistance line in mid-February. and then resistance in early March. 105.55 was the first swing low.

The 105.25 low is the next line to watch, serving as a low point around the same time. The new low of 104.60 is the next level to watch. Below this, 103.10 is an old level from 2016.

USD/JPY Daily Chart

USD/JPY Sentiment

I remain bearish on USD/JPY

The pair may have ended its recovery in FY 2017 and could resume its rise in April. The political scandal in Japan alongside jittery stocks could weigh.

Our latest podcast is titled The Powell Power Play.

Further reading:

- EUR/USD forecast – for everything related to the euro.

- GBP/USD forecast – Pound/dollar projections

- AUD/USD forecast – analysis for the Aussie dollar.

- USD/CAD forecast – Canadian dollar predictions

Safe trading!