- The implied volatility premium for JPY calls (bullish bets) has hit the lowest level since July 18.

- The sharp drop in the demand for JPY calls validates the USD/JPY’s jump to a 13-month high of 114.00.

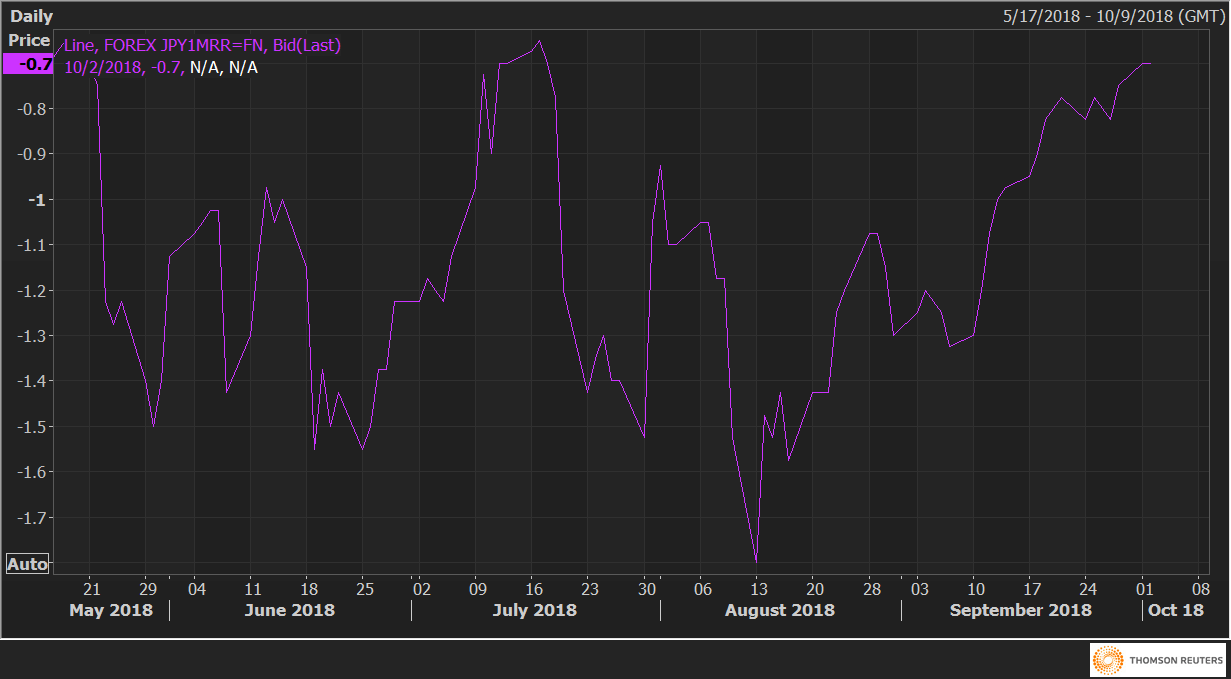

The USD/JPY one-month 25 delta risk reversals (JPY1MRR) are currently being paid at -0.70 – the highest level since July 18. A month ago, the risk reversals stood at -1.7.

The rise from -1.7 to -0.70 represents a drop in demand or implied volatility premium for the cheap out-of-the-money JPY call options and indicates the investors are likely expecting the JPY to continue losing altitude in the near-term.

JPY1MRR