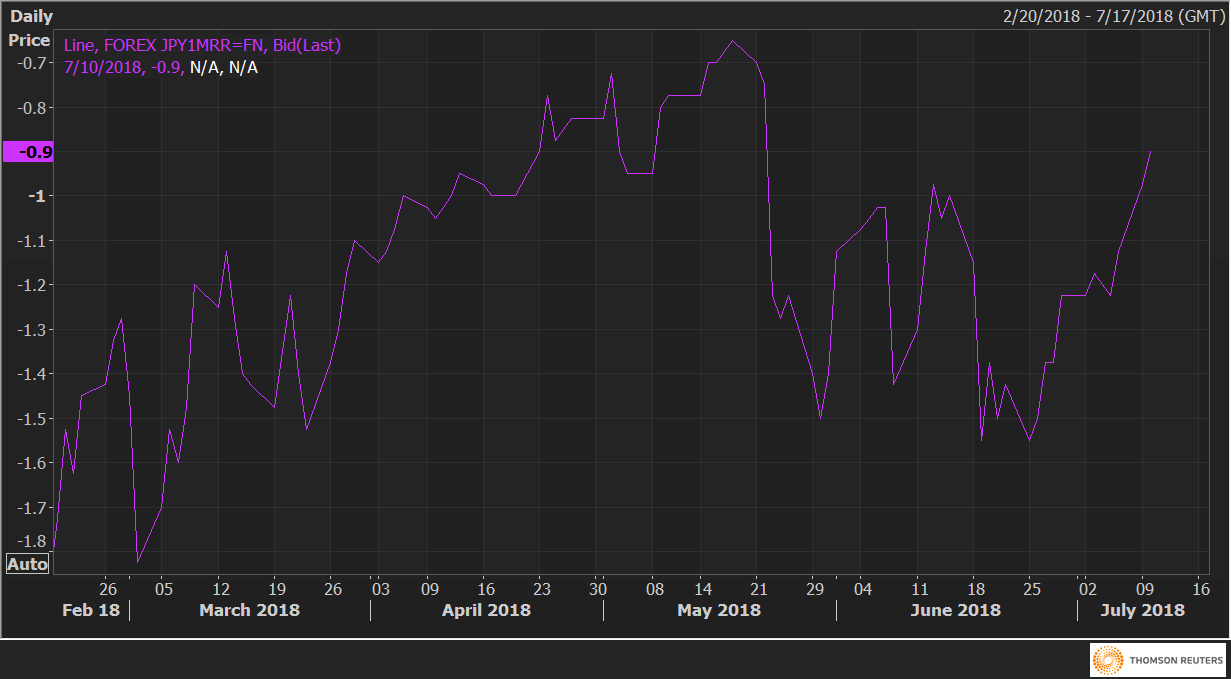

- USD/JPY risk reversals show JPY call demand (bullish bias) is weakest since May 22.

- The data shows investors are likely preparing for a long-term bull breakout in the USD/JPY pair.

The USD/JPY pair looks set to test 2015-2018 down trendline, currently located at 111.55, and may possibly break higher on growing Fed-BOJ divergence, having created a bullish outside-day candle on Monday.

The investors are likely preparing for a bullish breakout, the options market data indicate. For instance, the USD/JPY one-month 25 delta risk reversals (JPY1MRR) rose to -0.9 – the highest level since May 22 vs the recent low of -1.6 seen on June 25.

The rise from -0.9 to -1.6 represents falling implied volatility premium for JPY calls or falling demand for JPY calls (bullish bets).

JPY1MRR