- USD/JPY is at a critical juncture while second wave noise pipes up and questions the USD dominance.

- US stocks could be on the verge of a breakdown, leading to a surge into the yen.

- Technically, USD/JPY is ripe for a sell-off if 108 level continues to guard.

USD/JPY is trading 107.85, +0.26% at the time of writing having travelled from a low of 107.52 to a high of 107.94, marking out the key levels for the week ahead.

Bulls have capitalised on a firm ending to the solid performing quarter for Wall Street where US stocks have continued higher despite the risks of COVID-19.

The Japanese yen saw major outflows into overseas investments towards the end of the month, but that could all come back on risks of a second wave rout on US stocks.

The US dollar, on the other hand, has been in recovery mode since the end of May’s decline from the 99 territories in DXY.

Second wave impact underestimated

-

Powell speech: Second coronavirus wave could force people to withdraw from economic activity

A second outbreak of the coronavirus could force governments and people to withdraw from the economic activity, Jerome Powell, Chairman of the Federal Reserve System, said on Tuesday.

As risks of second waves elsewhere start to really play havoc, equity markets may come under pressure over the short-term, which could offer some support to the yen and help USD/JPY edge back towards 105.

However, as the coronavirus pessimism continues to mount, at least from the ‘experts’, markets may soon begin to take heed.

In terms of a clean bill of coronavirus health, Japan, much like nations such as Australia, has remained an outperformer by global standards which also goes in the yen’s favour.

USD/JPY’s technical outlook

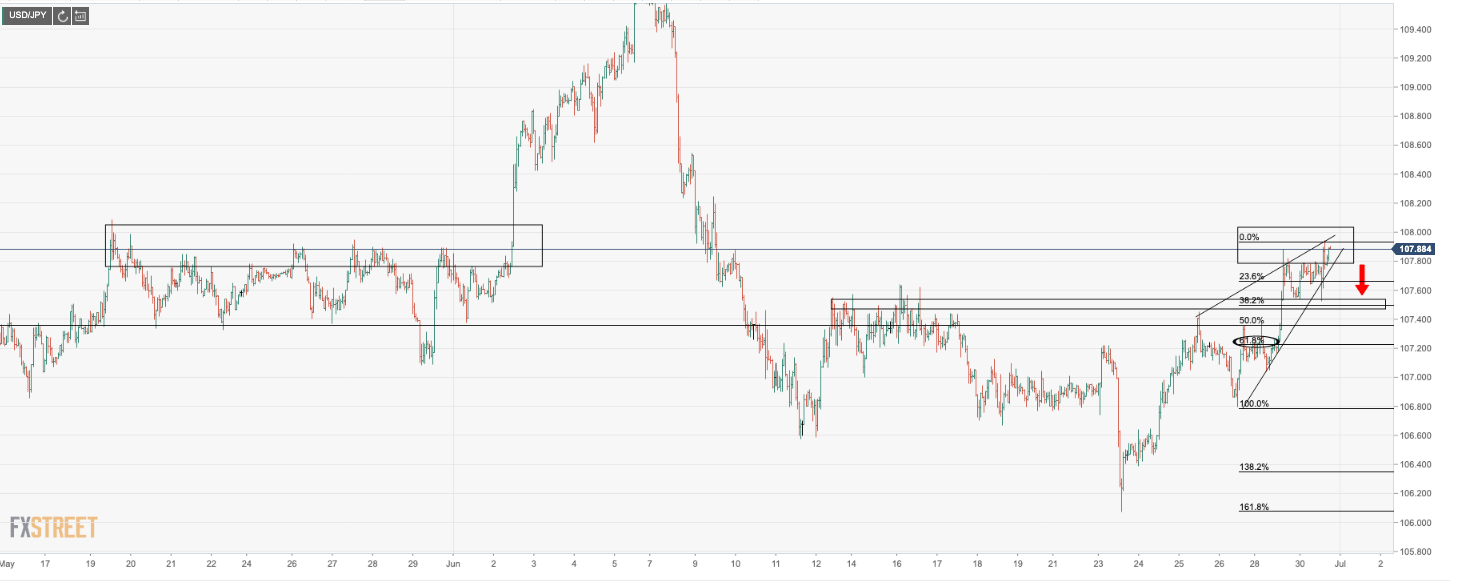

In meeting upside resistance structure formed in May, USD/JPY is on the verge of a breakout one way or the other.

At the top of the recent rally, the price continues to print higher lows at a faster rate than higher highs while upside momentum is slowing.

Following a bullish break of an hourly symmetrical triangle, the price has also formed a shorter-term rising wedge formation within a longer-term rising wedge.

This makes for a bearish outlook, signalling that a firm breakout to the downside is on the cards if the 108 level can’t be penetrated.

107.40/50 is a critical support structure to the downside which guards a run to prior structure and a 61.8% retracement on the Fibonacci scale to 107.20.

Hourly chart

Rising wedge at the end of a bearish trend is bearish. Bulls failing to print higher highs at the same rate as higher lows, meeting supply.

A distribution phase could be on the cards.

108.37 holds the 200-day ma which protects room towards the 109.85/98 recent high and 200-week ma.