Dollar/yen dropped to a new 16-month low of 104.63 and for good reasons. Concern about the global trade was a primary driver and trouble is not over. The last week of March is the end of the fiscal year in Japan. In addition, US GDP, the Tokyo inflation report, and politics may have their say again.

USD/JPY fundamental movers

Trade, White House Chaos and a dovish hike

The Trump Administration moved on from steel and aluminum tariffs to specific trade measures against China. The fear of a global trade war sent money into the safe-haven Japanese yen. Japan was not exempted from the new tariffs on steel and aluminum.

Another reason for the fall of the pair also came from the White House. The National Security Adviser H.R. McMaster was ousted and John Bolton, a hawk, comes instead. This raises concerns about the progress made in talks with North Korea about abandoning its nuclear weapons.

The Fed also weighed on the US Dollar by leaving the dot-plot unchanged at three hikes in 2018. The rate hike that Powell announced in his first decision was entirely priced in.

US Final GDP, Japanese inflation

After the stock market crash on Friday, the Tokyo open will be eyed. Another slide in stocks may send the pair lower. Trade fears haven’t waned over the weekend.

The economic calendar is not as busy, but US GDP on Wednesday and the Core PCE on Thursday (the Fed’s favorite inflation measure) stand out.

In Japan, the Tokyo Core CPI for March will be released on Thursday at 23:30. Any uptick from the current 0.9% y/y will boost the yen. However, inflation remains stubbornly low in Japan, as in other developed economies.

Also, watch out for last-minute moves as the fiscal year ends in Japan this week. Portfolio managers may move markets with their adjustments.

See all the main events in the Forex Weekly Outlook

Key news updates for USD/JPY

[do action=”autoupdate” tag=”USDJPYUpdate”/]USD/JPY Technical Analysis

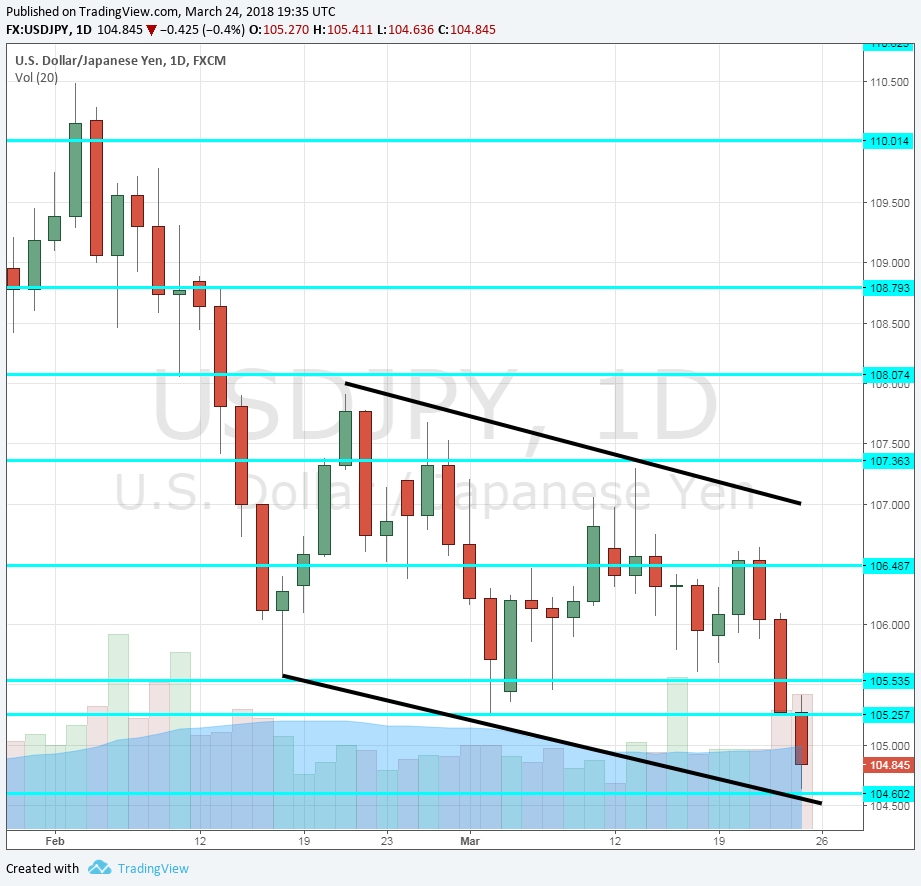

112.90 served as support in December and is a pivotal line in the range. 112.20 used to be important in the past.

It is closely followed by 111.70, which provided support back in October. The round level of 111 worked as a cushion to the pair in November.

Looking down, 110.70 was a separator of ranges in June and remains important. The round number of 110 serves as a psychological level.

109 was a pivotal line within the range. 108.30 was the low seen in late January. Even lower, we find 107.30 was the low in September and now turns into resistance.

106.50 was a resistance line in mid-February. The 105.25 low is the next line to watch, serving as a low point around the same time.

The new low of 104.60 is the next level to watch. Below this, 103.10 is an old level from 2016.

USD/JPY Daily Chart

USD/JPY Sentiment

I remain bearish on USD/JPY

The pair may be in oversold territory and may temporarily recover, but this recovery is likely to be short-lived. Falling stocks are not good for the pair and neither are trade wars.

Our latest podcast is titled The Powell Power Play.

Further reading:

- EUR/USD forecast – for everything related to the euro.

- GBP/USD forecast – Pound/dollar projections

- AUD/USD forecast – analysis for the Aussie dollar.

- USD/CAD forecast – Canadian dollar predictions

Safe trading!