Dollar/yen fell sharply to the lowest levels since September. Does it have more in store? The drop is mostly a result of the weakness of the US dollar, also fuelled by commentary from Mnuchin. Yet the BOJ also had a minor role in pushing the yen higher.

USD/JPY fundamental movers

“A weak dollar is good for the US”

The US Treasury Secretary Steven Mnuchin said that “a weak dollar is good for the US”, and this sent the greenback plunging. It was already under pressure amid the short government shutdown and fears of a trade war after Trump slapped tariffs on washing machines and solar panels.

The comments by Mnuchin somewhat taken out of context but were still a departure from traditional US policy which endorses a strong dollar. President Trump later cheered a strong dollar that “will get even stronger” but that didn’t last for too long.

In Japan, the BOJ left its very loose monetary policy unchanged and this was supposed to send the yen lower. However, yet another comment may have been misinterpreted. BOJ Governor Kuroda said that there is progress on inflation.

All in all, USD/JPY tumbled down.

Yellen’s last stand, NFP

As the page turns onto February, we will get Janet Yellen’s last Fed meeting as Chair of the Federal Reserve. No change is expected in a meeting that does not consist of new forecasts nor a press conference. However, the statement may still be of interest, especially as there is a rotation in the voting composition of the Fed. The Non-Farm Payrolls consist of a short-buildup and expectations for more of the same: 184K jobs gained and a 0.3% m/m gain in jobs.

See all the main events in the Forex Weekly Outlook

Key news updates for USD/JPY

[do action=”autoupdate” tag=”USDJPYUpdate”/]USD/JPY Technical Analysis

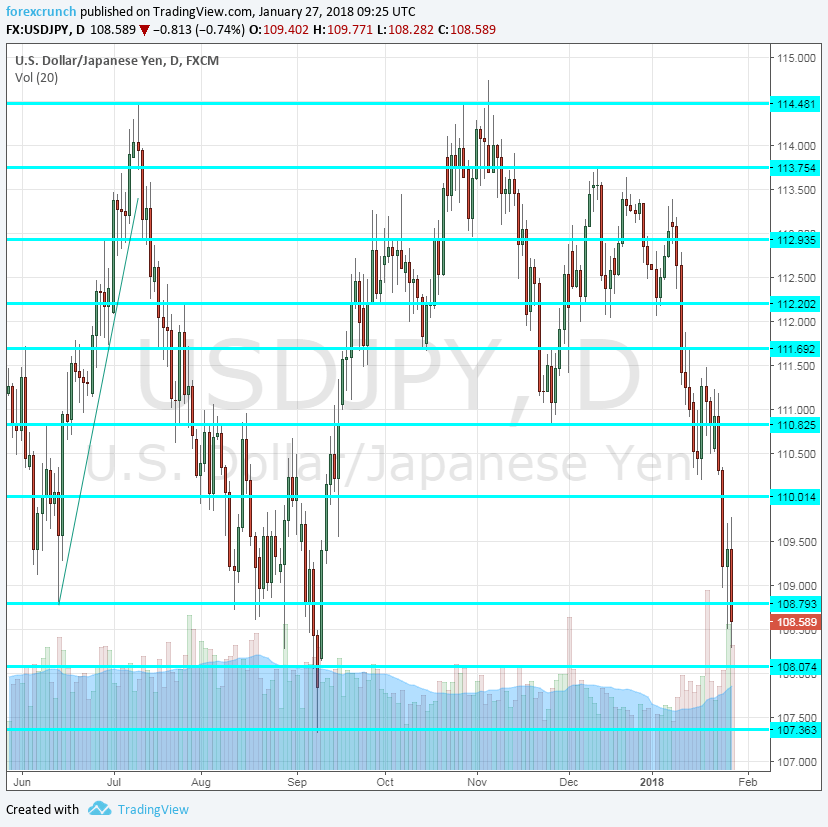

112.90 served as support in December and is a pivotal line in the range. 112.20 used to be important in the past.

It is closely followed by 111.70, which provided support back in October. The round level of 111 worked as a cushion to the pair in November.

Looking down, 110.70 was a separator of ranges in June and remains important. 109.60 was a gap line in late April, a gap that was never closed.

In June, the pair found support several times at 109.10 and this also works as support. Further below, the cycle low of 108.10 is of high importance. Even lower, we find 107.10 as the ultimate level.

If the pair falls even lower, the round number of 105 will come into play, followed by 103.30.

USD/JPY Daily Chart

USD/JPY Sentiment

I remain bearish on USD/JPY

While the dollar’s fall may be overstretched, the political uncertainty and the not-so-great GDP numbers in the US may keep the pressure on the dollar.

Our latest podcast is titled Dollar downfall and America’s economy

Further reading:

- EUR/USD forecast – for everything related to the euro.

- GBP/USD forecast – Pound/dollar projections

- AUD/USD forecast – analysis for the Aussie dollar.

- USD/CAD forecast – Canadian dollar predictions

Safe trading!