- USD/JPY trades around 110.65 ahead of European markets open on Wednesday.

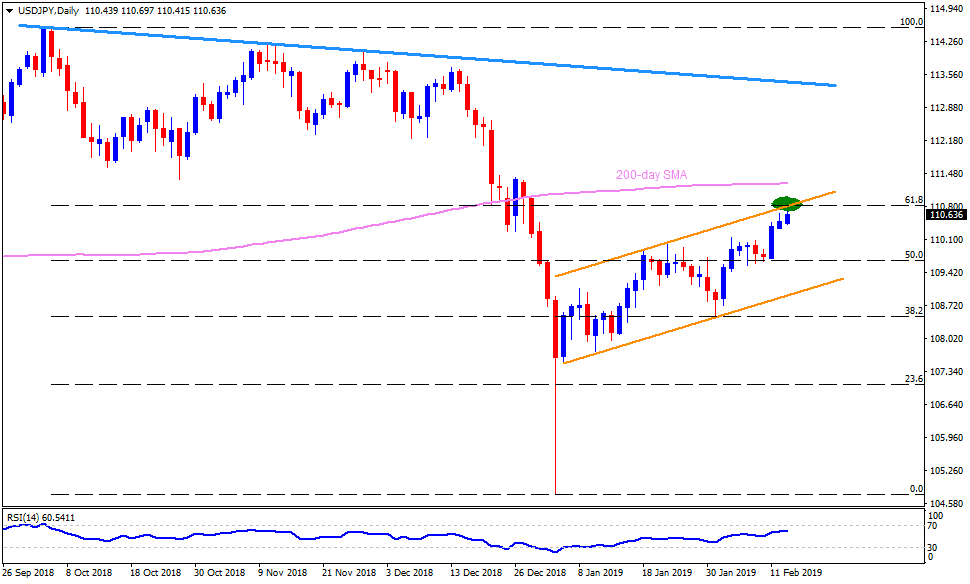

- The pair remains well passed the two-week high and follows short-term ascending trend-channel.

- However, resistance line of the channel formation and 61.8% Fibonacci retracement of October to January decline, at 110.80, can challenge recent upside momentum.

- Hence, buyers need to conquer the 110.80 mark on a daily closing basis prior to confronting the 200-day SMA level of 111.30 and October month low near 111.40.

- Should there be a pullback, 110.30 and 110.00 could offer immediate support, a break of which drag the quote to 109.80 and 109.10.

- During the pair’s extended downturn under 109.10, support-line of the channel, at 108.90, may become sellers’ favorite as it holds the gate for the pair’s drop to 108.50 and 108.00 supports.

USD/JPY daily chart

Additional important levels:

Overview:

Today Last Price: 110.65

Today Daily change: 18 pips

Today Daily change %: 0.16%

Today Daily Open: 110.47

Trends:

Daily SMA20: 109.62

Daily SMA50: 110.3

Daily SMA100: 111.69

Daily SMA200: 111.28

Levels:

Previous Daily High: 110.66

Previous Daily Low: 110.34

Previous Weekly High: 110.16

Previous Weekly Low: 109.43

Previous Monthly High: 110

Previous Monthly Low: 104.75

Daily Fibonacci 38.2%: 110.54

Daily Fibonacci 61.8%: 110.46

Daily Pivot Point S1: 110.33

Daily Pivot Point S2: 110.18

Daily Pivot Point S3: 110.01

Daily Pivot Point R1: 110.64

Daily Pivot Point R2: 110.8

Daily Pivot Point R3: 110.95