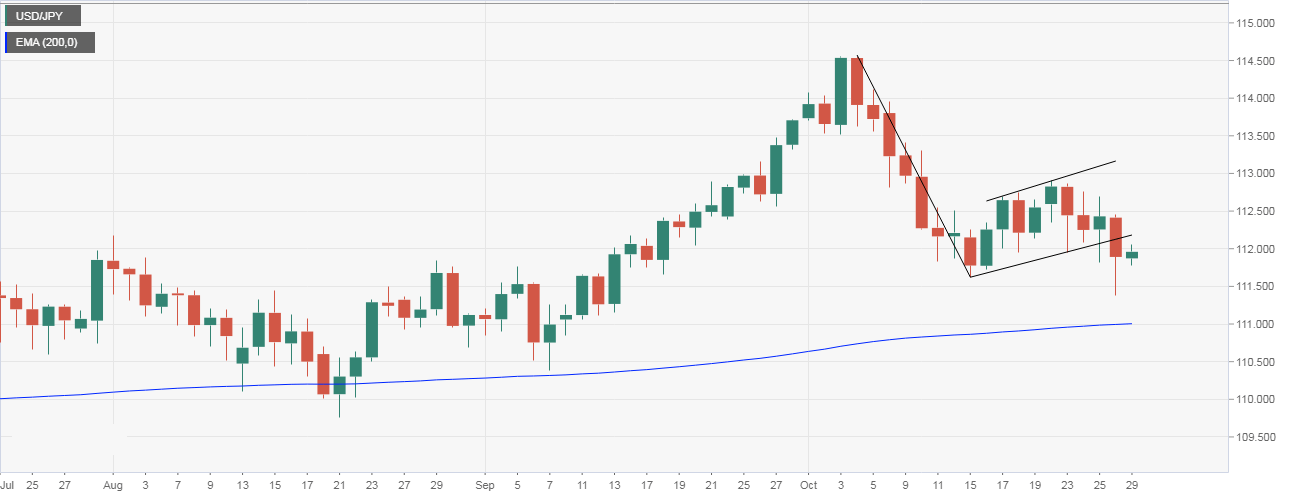

- The USD/JPY pair closed well below 112.10, confirming a bear flag breakdown – a bearish continuation pattern – which indicates a resumption of the sell-off from the recent high of 114.55.

- The bearish pattern has opened the doors to a sell-off to levels below 110.00. On the way lower, the pair may encounter support at 110.97 (200-day exponential moving average).

- A close above Friday’s high of 112.44 would invalidate the bearish setup.

Daily chart

Spot Rate: 111.97

Daily High: 112.05

Daily Low: 111.77

Trend: Bearish

Resistance

R1: 112.19 (lower edge of the flag)

R2: 112.44 (Friday’s high)

R3: 112.89 (Oct. 22 high)

Support

S1: 111.62 (Oct. 15 low)

S2: 111.38 (Friday’s low)

S3: 110.97 (200-day EMA)