- USD/JPY is losing about 90 pips on Friday amid broad-based USD selling.

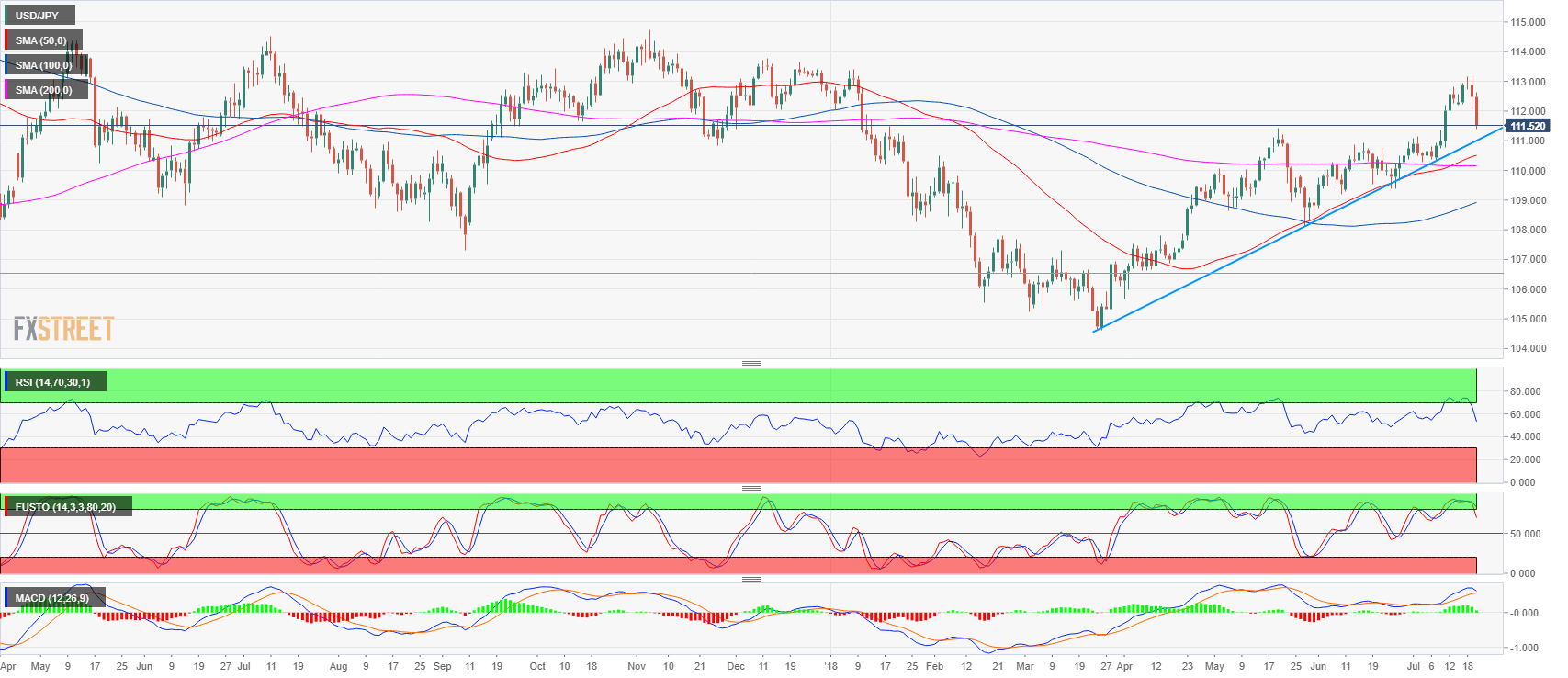

- USD/JPY is still holding above a daily trendline from March, 26 suggesting that the bull trend is still in effect. However, the sell-off is happening near the 2018 high and just below the weekly 200-period simple moving average, increasing the odds of a successful bearish reversal.

- USD/JPY just found support at 111.39 May 21 swing high and while a bounce can be expected it remains to be seen if the bull trend can actually resume to new highs.

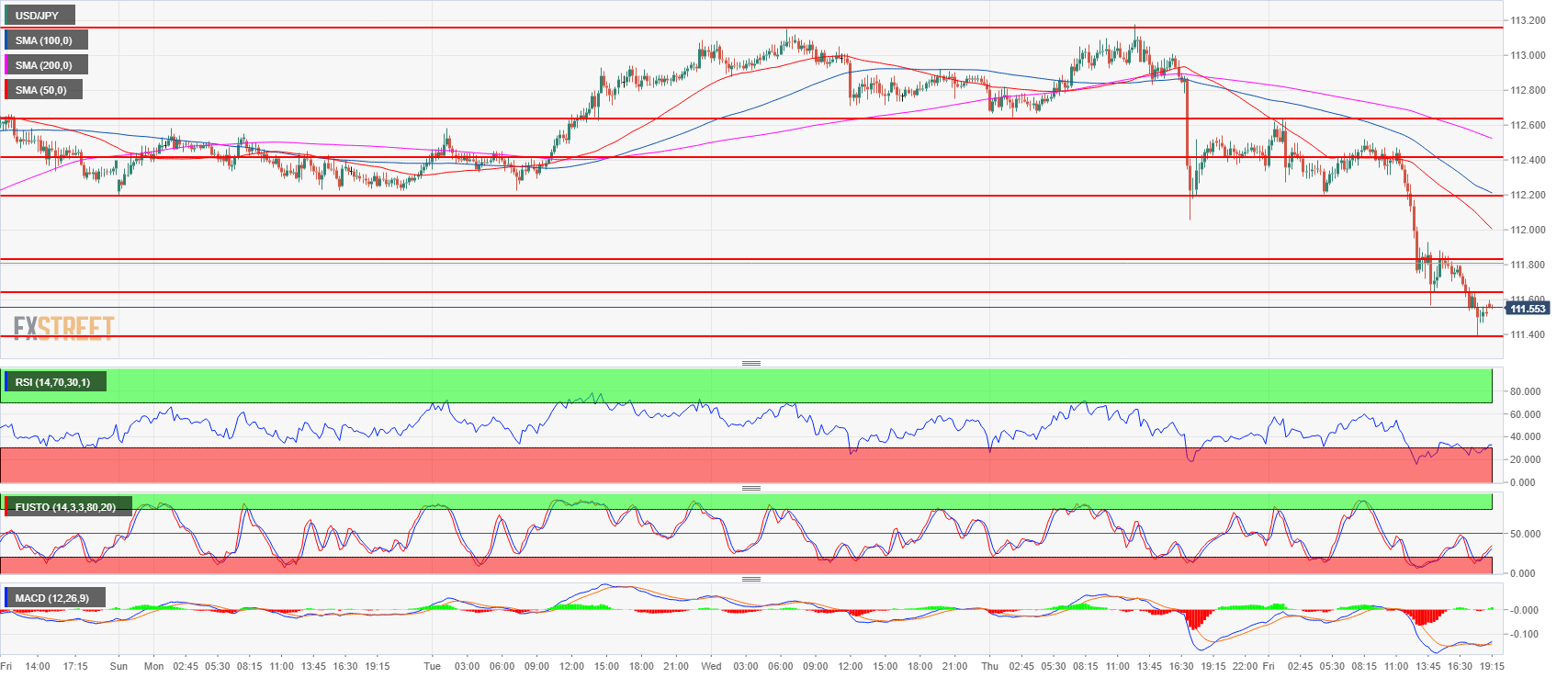

USD/JPY 15-minute chart

Spot rate: 111.56

Relative change: -0.81%

High: 112.64

Low: 111.39

Trend: Bullish / Risk of bearish reversal

Resistance 1: 111.60-111.80 area, 23.6% and 38.2% Fibonacci retracement low/high July 11

Resistance 2: 112.19-112.40 area, July 11 high and intraday swing low

Resistance 3: 112.64 July 12 high

Resistance 4: 113.18, 2018 high

Resistance 5: 113.26-113.38, 200-weekly simple moving average and January 8 high

Resistance 6: 114.45 October 27, 2017 high

Support 1: 111.39 May 21 swing high

Support 2: 111.02-111.16 previous intraday swing lows

Support 3: 110.90 June 15 swing high

USD/JPY Daily chart