- The demand for Yen as a safe-haven currency has been weak in the last three days.

- The levels to beat for bulls are at the 106.30 and 106.55 resistances.

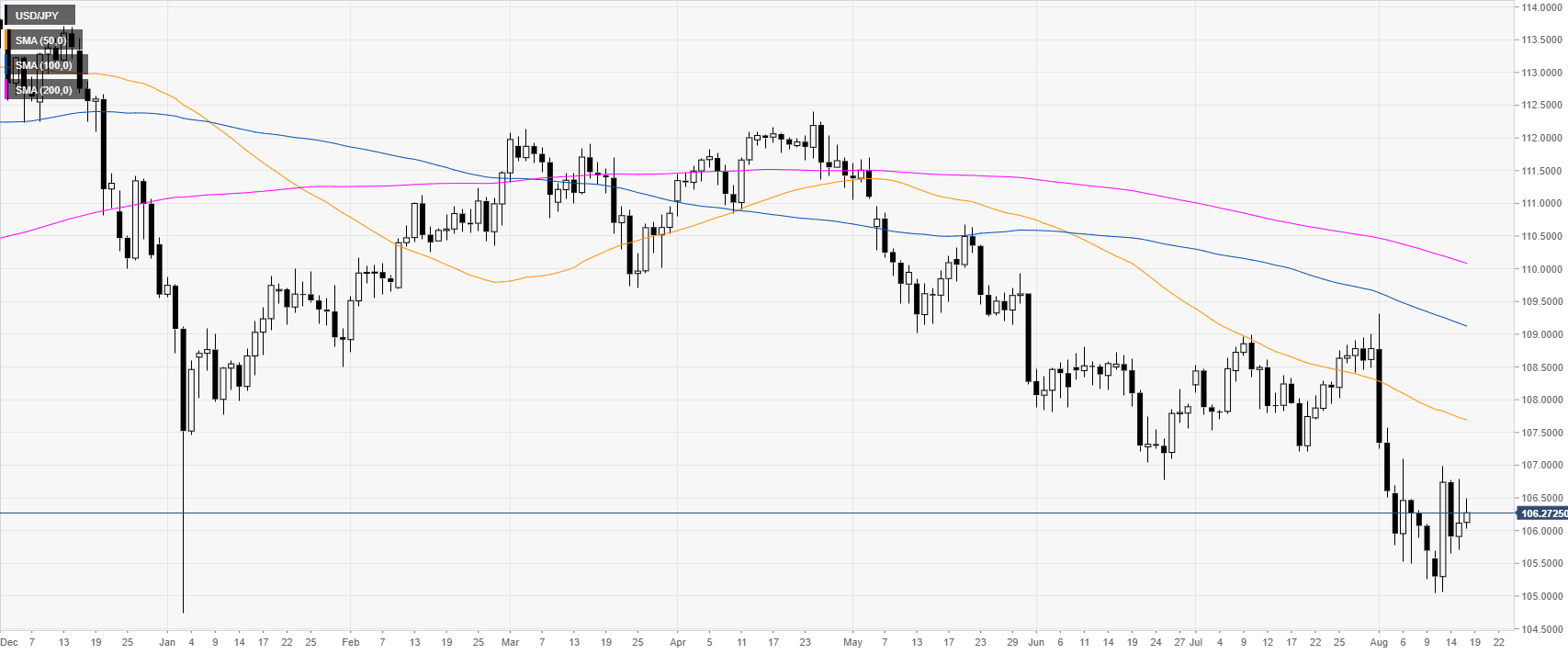

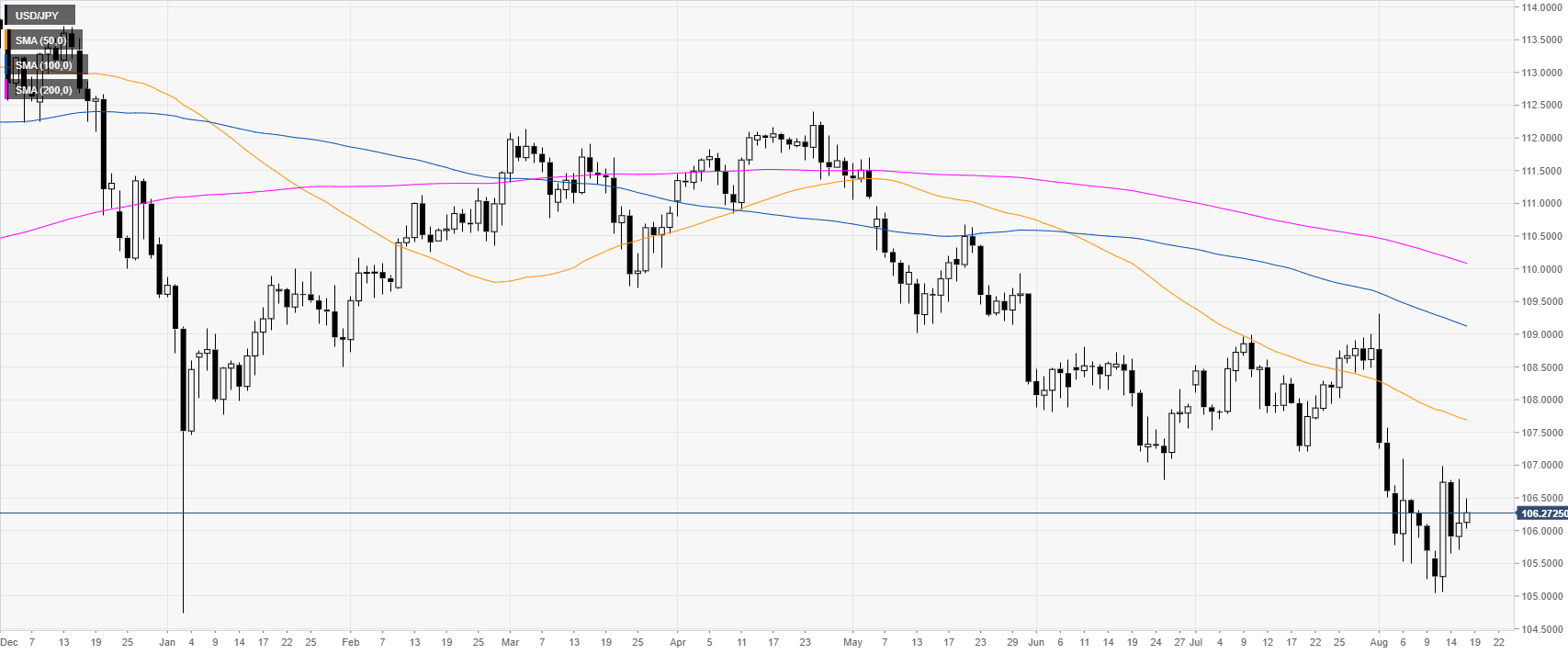

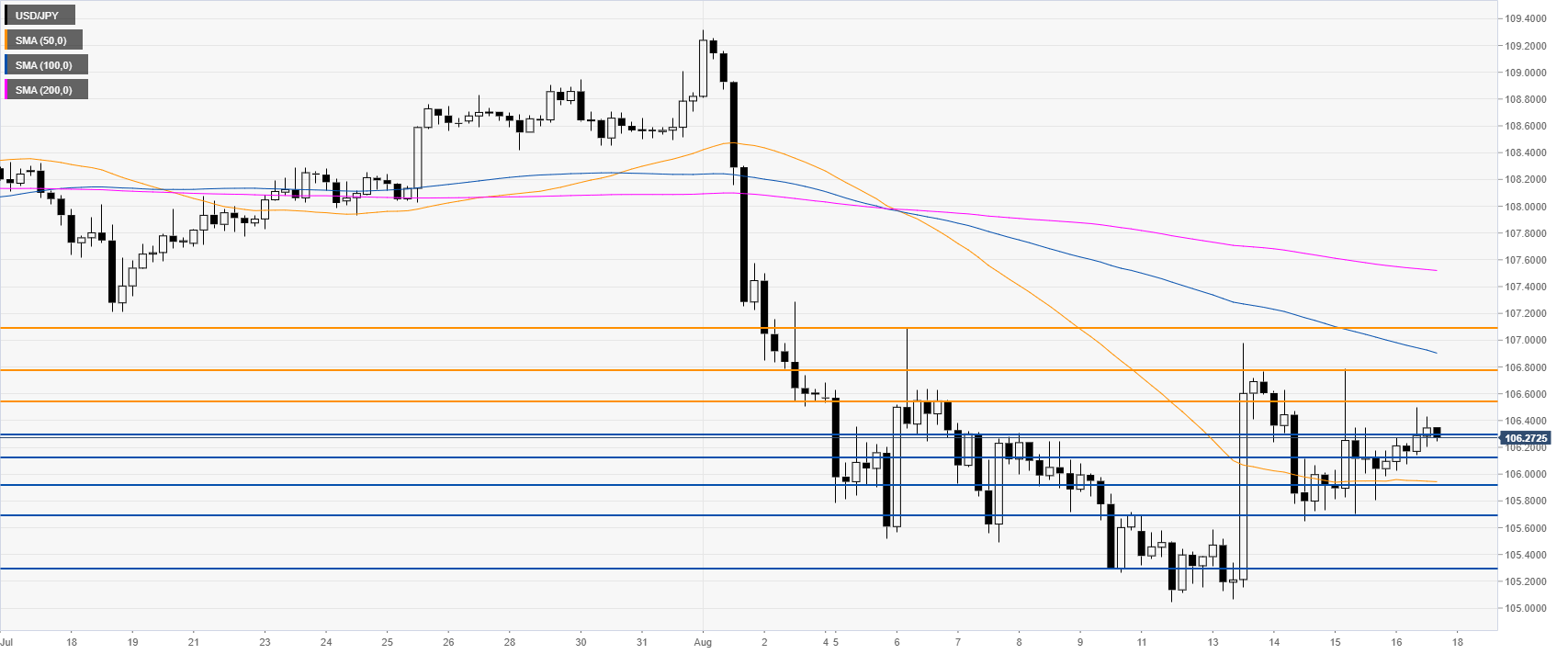

USD/JPY daily chart

USD/JPY is trading off multi-month lows while under the main daily simple moving averages (DSMAs). The market is trading just above the 106.00 handle. Trade war news and US bond yields are the primary drivers of the USD/JPY currency pair.

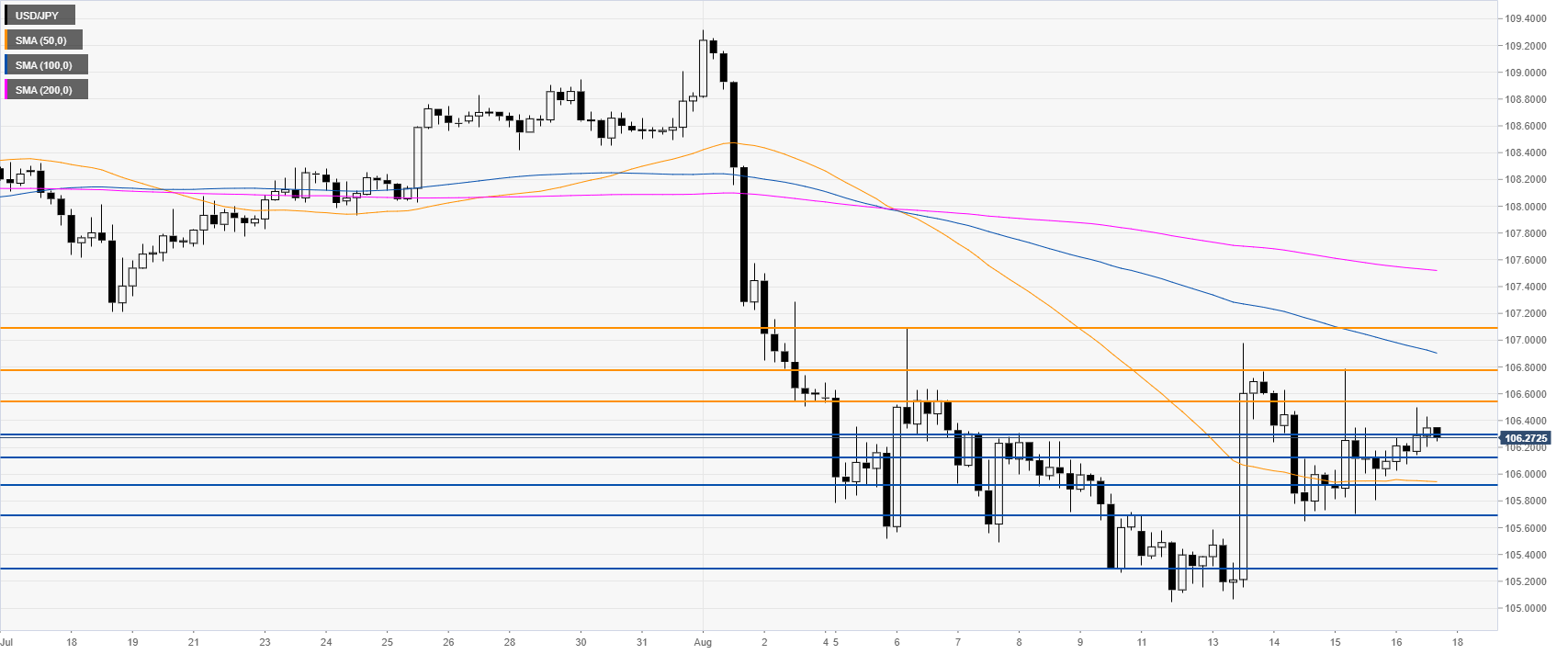

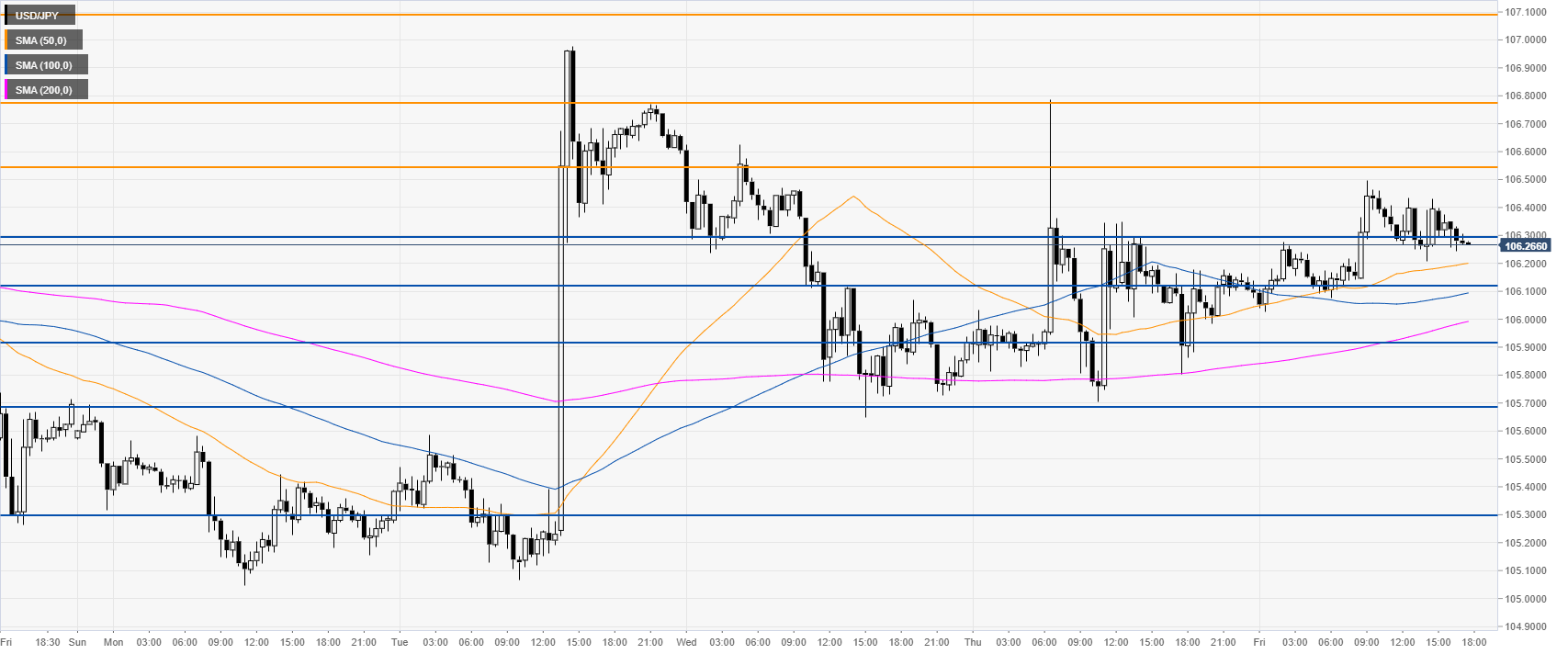

USD/JPY 4-hour chart

USD/JPY made no significant progress in the last two days as the market is trading above the 50 SMA. The bears would need to break below 106.12 to reach 105.92, 105.68 and 105.30, according to the Technical Confluences Indicator.

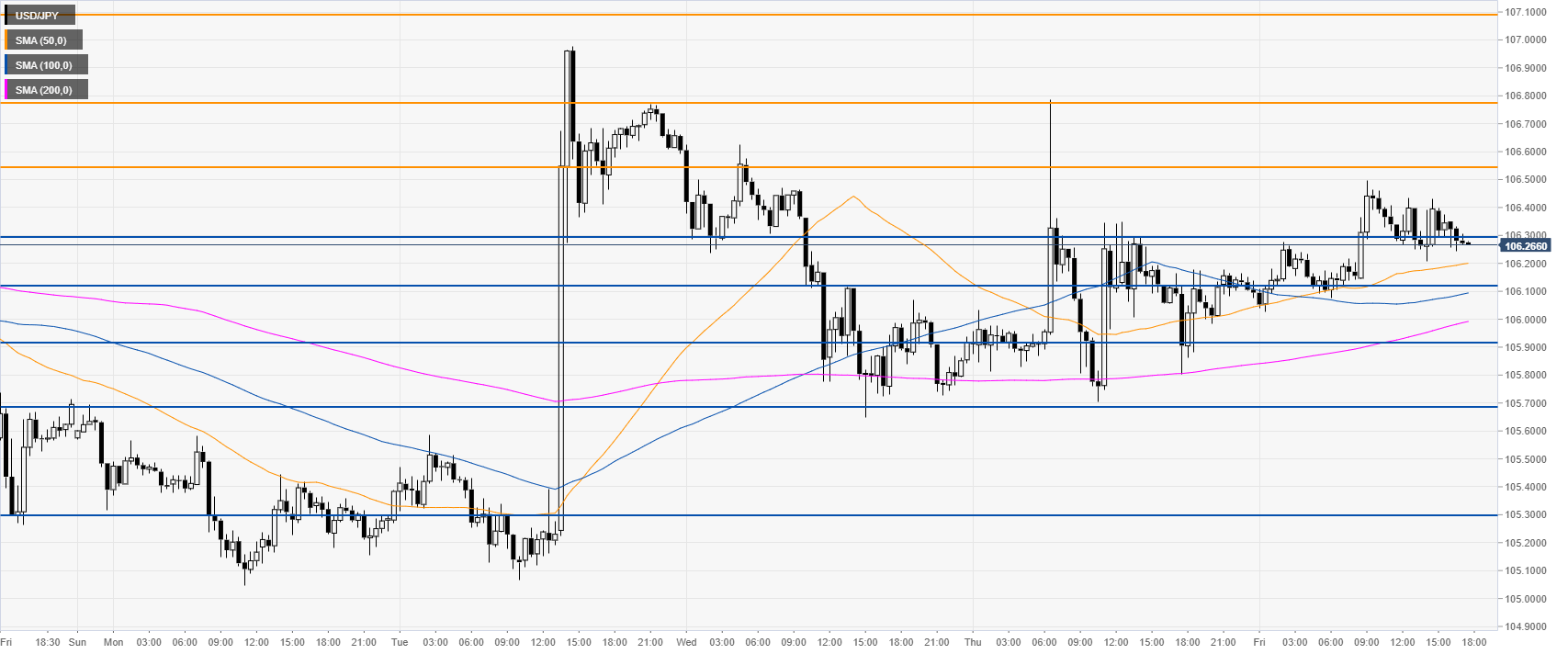

USD/JPY 30-minute chart

Dollar/Yen is trading its main SMAs as the market is consolidating Tuesday’s bullish move. There could be upside momentum next week. However, bulls have several layers of resistances to break at 106.30, 106.55 and 106.77 levels, according to the Technical Confluences Indicator.

Additional key levels