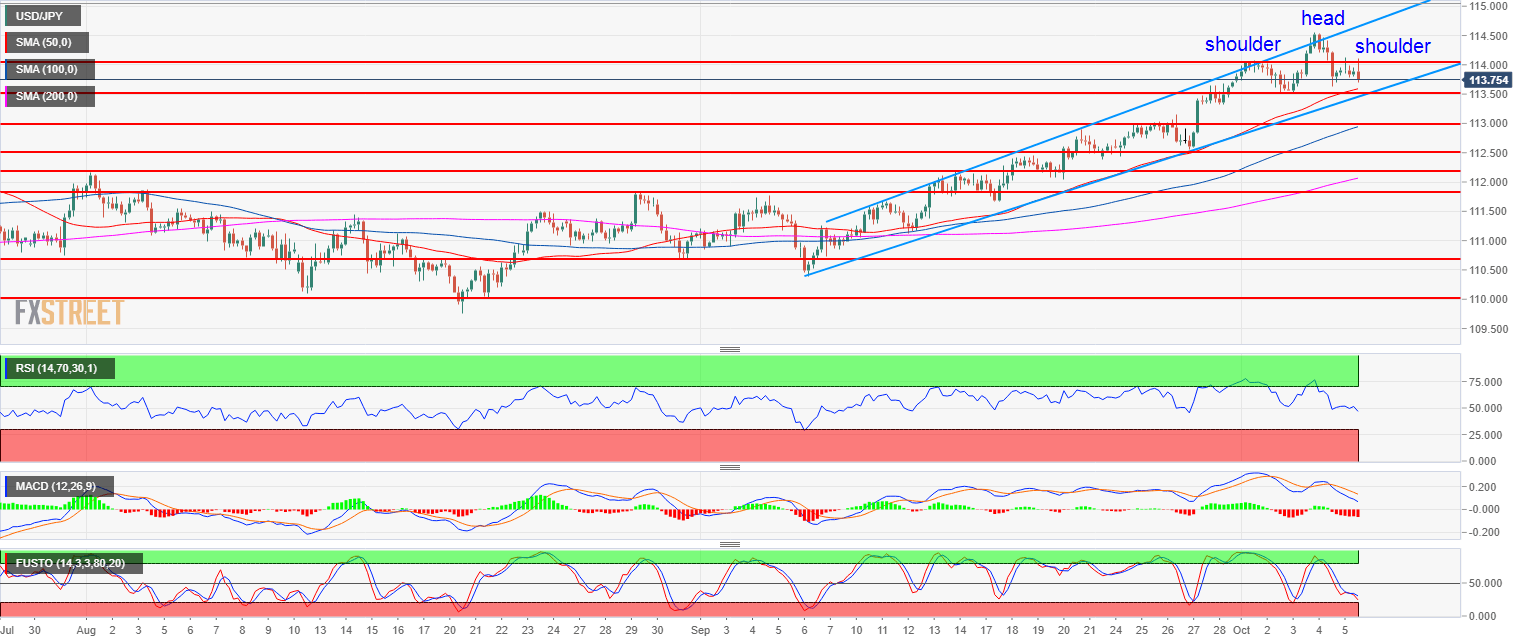

- USD/JPY is in a strong bull trend as it is trading above its 50, 100 and 200-period simple moving average.

- USD/JPY might be set for a corrective move down as a head-and-shoulders pattern is in the making. The RSI, MACD and Stochastics indicators are also losing steam.

- The current context suggests that a pullback down to 113.55 (October 2 low) and possibly to 113.18 can be next.

Spot rate: 113.71

Relative change: -0.17%

High: 114.12

Low: 113.68

Main trend: Bullish

Resistance 1: 114.00 figure

Resistance 2: 114.80 November 2017 high

Resistance 3: 115.50 March 10, 2017 high

Support 1: 113.55 October 2 low

Support 2: 113.18, July high

Support 3: 112.50 figure

Support 4: 112.00-112.17 zone, figure and August 1 swing high

Support 5: 111.84 August 29 swing high