- USD/JPY is better bid for the third straight trading day.

- Buyers are struggling to push the spot above key resistance at 110.31

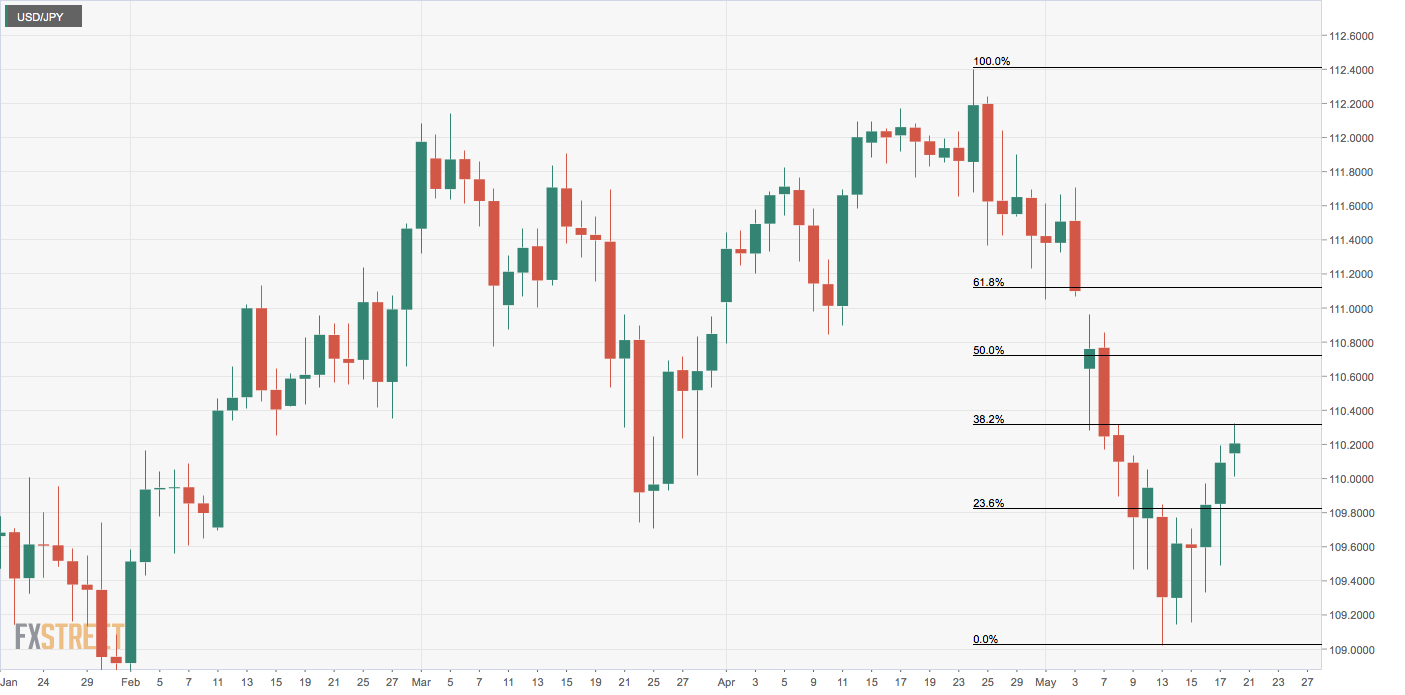

USD/JPY is currently trading at 110.18, having faced rejection at 110.31 – 38.2% Fib retracement of the sell-off from 112.40 to 109.02 – earlier today.

The currency pair picked up a bid near 110.00 in early Asia, having registered gains in the previous two trading days.

The uptick could be associated with the improved risk sentiment in the financial markets, as represented by the 0.30% gain in the S&P 500 futures seen at press time. Asian stocks are also flashing green with Australia’s S&P/ASX 200 trading at the highest level since December 2007.

Looking forward, the pair may continue to track the action in the equities. Technically speaking, the short-term outlook would turn bullish if and when the pair closes above the key Fib resistance of 110.31.

A repeated rejection at that hurdle could entice sellers, leading to a retest of the recent low of 109.02.

Daily chart

Trend: Bullish above 109.31

Pivot points