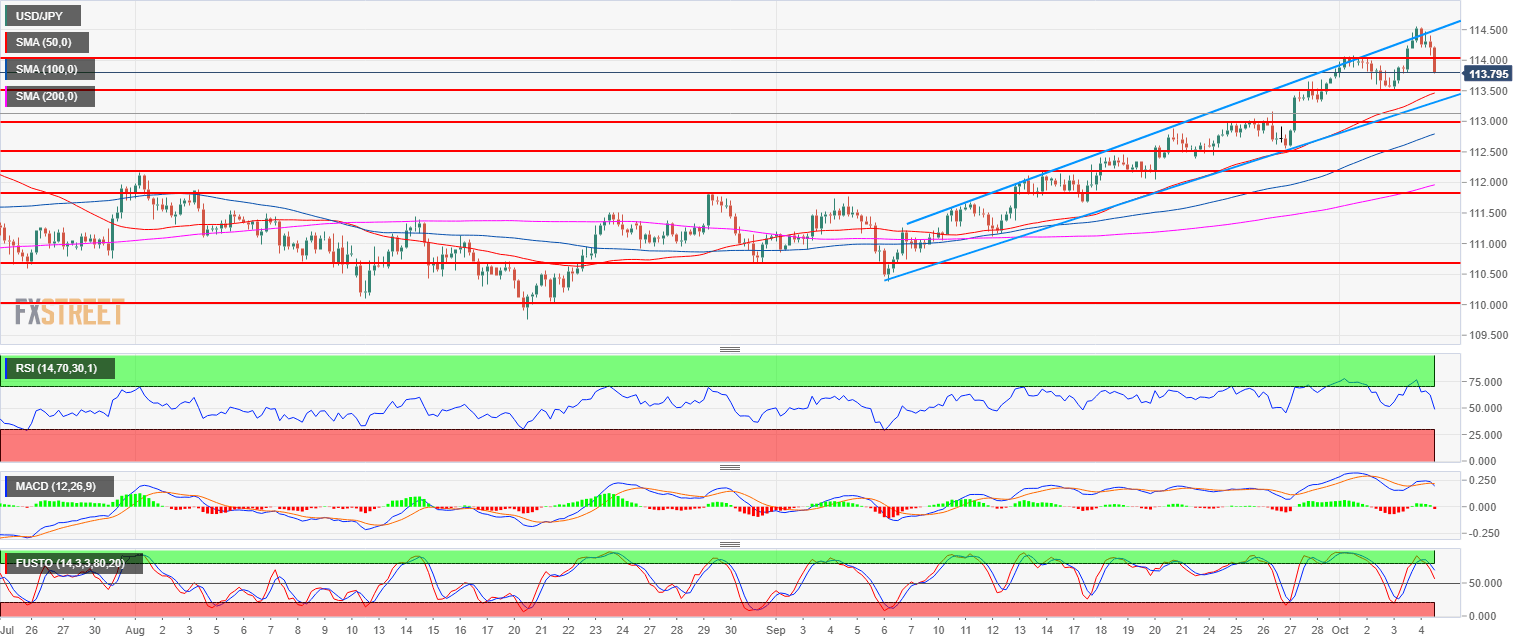

- USD/JPY is in a strong bull trend.

- USD/JPY is currently pulling back below the 114.00 figure while the RSI, MACD and Stochastics are turning lower. The correction can extend to 113.55 (October 2 low).

- The 50, 100 and 200-period simple moving averages are rising and widening suggesting a strong bullish bias.

USD/JPY 4-hour chart

USD/JPY

Overview:

Last Price: 113.91

Daily change: -63 pips

Daily change: -0.550%

Daily Open: 114.54

Trends:

Daily SMA20: 112.45

Daily SMA50: 111.64

Daily SMA100: 111.11

Daily SMA200: 109.83

Levels:

Daily High: 114.56

Daily Low: 113.52

Weekly High: 113.71

Weekly Low: 112.39

Monthly High: 113.71

Monthly Low: 110.38

Daily Fibonacci 38.2%: 114.16

Daily Fibonacci 61.8%: 113.91

Daily Pivot Point S1: 113.85

Daily Pivot Point S2: 113.16

Daily Pivot Point S3: 112.8

Daily Pivot Point R1: 114.89

Daily Pivot Point R2: 115.25

Daily Pivot Point R3: 115.94

Main trend: Bullish

Resistances and Supports:

Resistance 1: 114.00 figure

Resistance 2: 114.80 November 2017 high

Resistance 3: 115.50 March 10, 2017 high

Support 1: 113.55 October 2 low

Support 2: 113.18, July high

Support 3: 112.50 figure

Support 4: 112.00-112.17 zone, figure and August 1 swing high

Support 5: 111.84 August 29 swing high