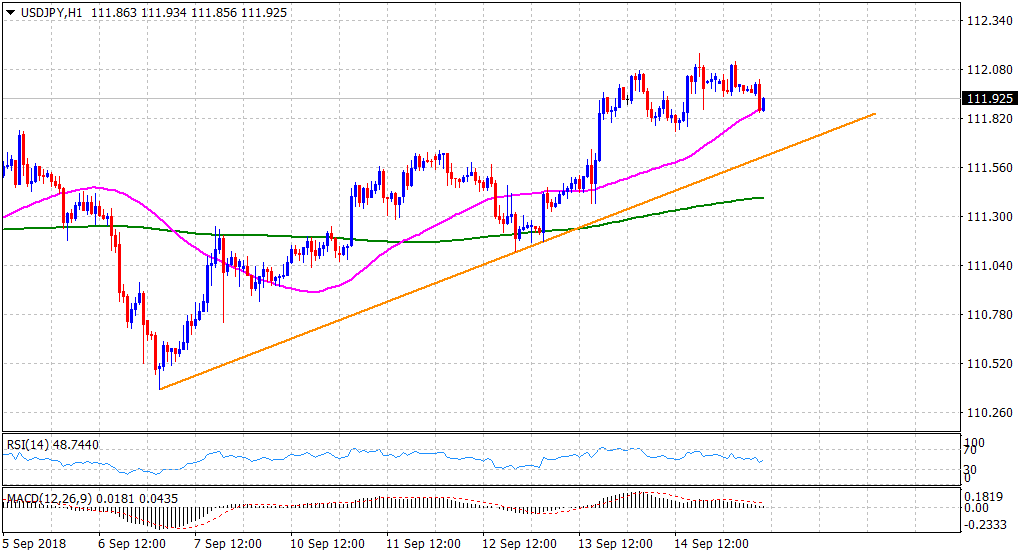

“¢ The pair finally broke down of its late Asian session consolidation phase and retreated farther from Friday’s near two-month tops, and the 112.00 handle, to test 50-hour SMA.

“¢ The prevalent risk-off mood, led by renewed US-China trade war fears, coupled with some USD selling were seen as key factors behind the latest leg of fall in the last hour.

“¢ Despite a combination of negative factors, the downfall remained rather limited and the momentum, so far, has been confined within Friday’s broader trading range.

“¢ Technical indicators on the 1-hourly chart have started losing positive momentum and thus, increase prospects for some additional intraday weakness amid escalating trade tensions.

“¢ However, a convincing move beyond 112.15 supply zone might negate any negative outlook and should pave the way for an extension of the last week’s positive momentum.

Spot Rate: 111.93

Daily High: 112.12

Trend: Bearish below 112.15 zone

Resistance

R1: 112.17 (near 2-month tops set on Friday)

R2: 112.55 (horizontal zone)

R3: 112.88 (July 17 daily closing high)

Support

S1: 111.64 (ascending trend-line on H1)

S2: 111.40 (200-period SMA H1)

S3: 111.00 (round figure mark)