- USD/JPY remains positive around three week top amid optimism surrounding the US-China trade deal.

- Pair’s sustained trading beyond 200-day SMA favors run-up to monthly high, 110.00 round-figure.

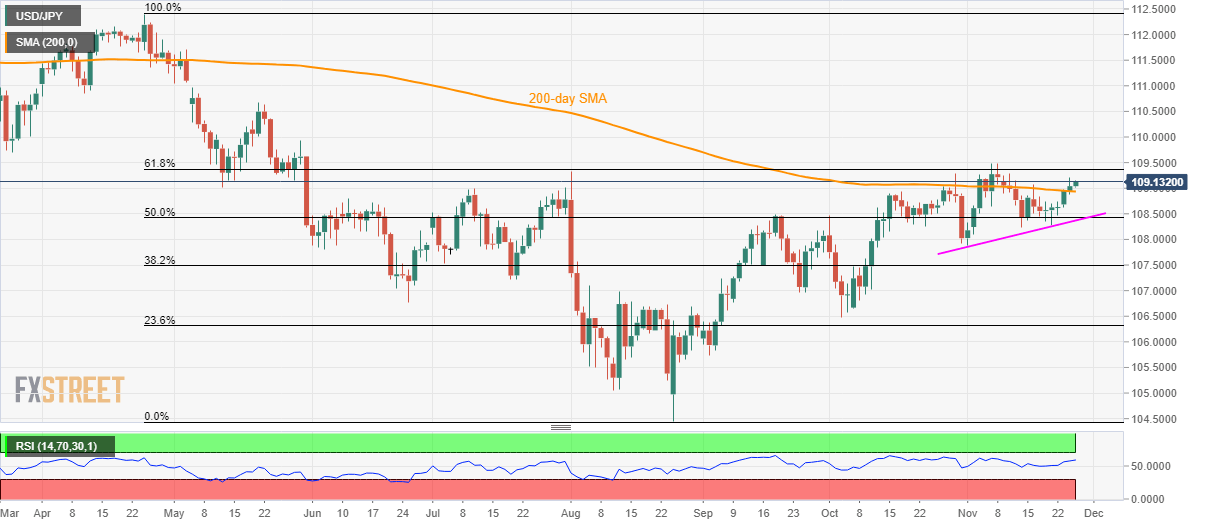

Following the USD/JPY pair’s first positive closing beyond 200-day Simple Moving Average (SMA) in nearly three weeks, the quote takes the bids to 109.15 amid pre-European session on Wednesday.

Not only pair’s sustained trading beyond the key SMA, optimism surrounding the phase one trade deal between the United States (US) and China also increases the odds of further prices increase.

Read: Sources: There is a major push to get the deal done and Phase One deal text is being finalized – WSJ

As a result, traders will now take aim at the monthly high close to 109.50 ahead of targeting the 110.00. Also, 61.8% Fibonacci retracement of April-August downpour, at 109.40, can offer an additional upside barrier.

On the contrary, a daily closing below 200-day SMA level of 108.93 could drag the quote to a 50% Fibonacci retracement level of 108.45 and monthly support line near 108.35.

USD/JPY daily chart

Trend: Bullish