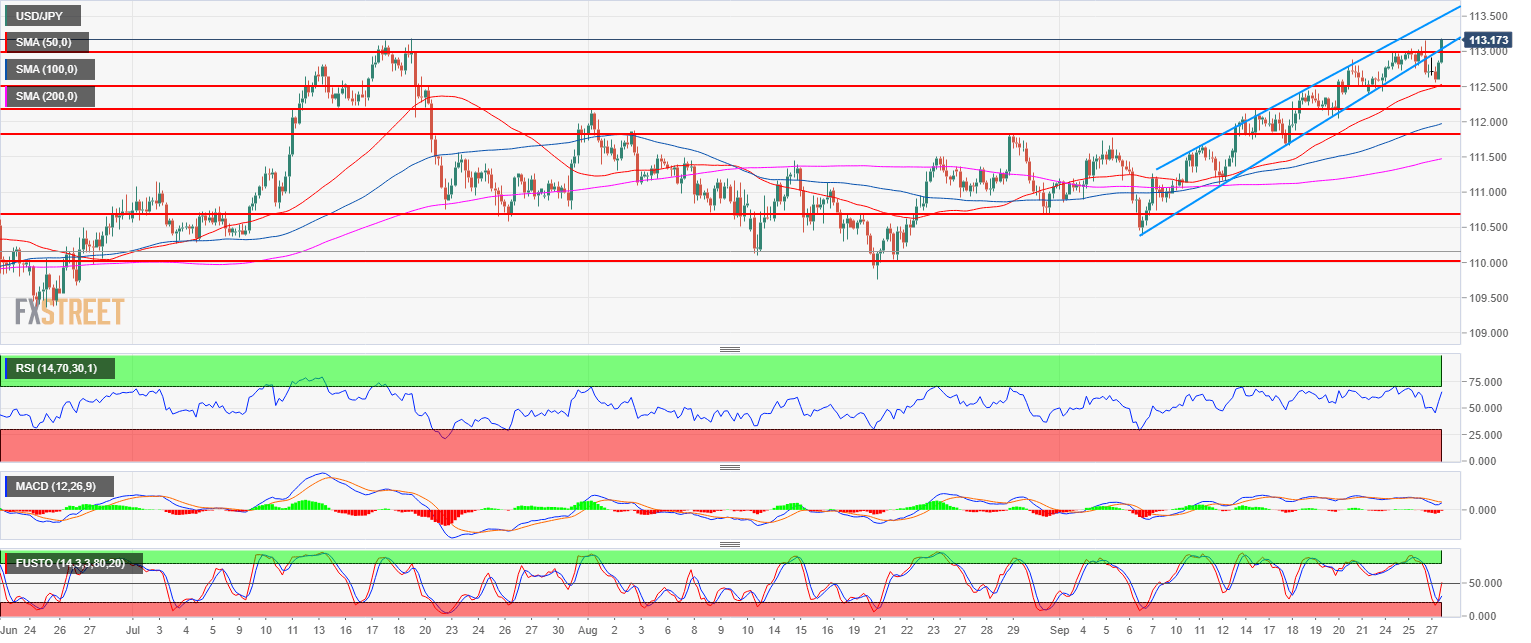

- USD/JPY bulls want to extend the bull trend as they are challenging the July high.

- The 50, 100 and 200-period simple moving average on the 4-hour time frame are rising and widening suggesting a bullish momentum. However, counter-trend traders are currently preventing the market to break above 113.18 July high. A clear breakout above the level would open the door to 114.00 figure and 114.80 (November 2017 high).

- However, in the absence of a sustained breakout above 113.18, bears have a fair chance to drive the market down near 112.00 figure.

Spot rate: 113.16

Relative change: 0.39%

High: 113.21

Low: 112.55

Main trend: Bullish

Short-term trend: Bearish reversal risk below 113.18

Resistance 1: 113.18, July high

Resistance 2: 114.00 figure

Resistance 3: 114.80 November 2017 high

Support 1: 112.50 figure

Support 2: 112.00-112.17 zone, figure and August 1, swing high

Support 3: 111.84 August 29 swing high

Support 4: 111.84 August 29 swing high

Support 5: 111.54 August 6, high

Support 6: 111.45 August 8 high

Support 7: 111.00 figure

Support 8: 110.75, July 23 swing low

Support 9: 110.00 figure

Support 10: 109.37 June 25 low