- USD/JPY is trading sideways for the second day in a row as market participants are awaiting the FOMC meeting minutes at 18:00 GMT.

- USD/JPY recovered Asian losses in the early European trade and is now consolidating above the 110.40 level.

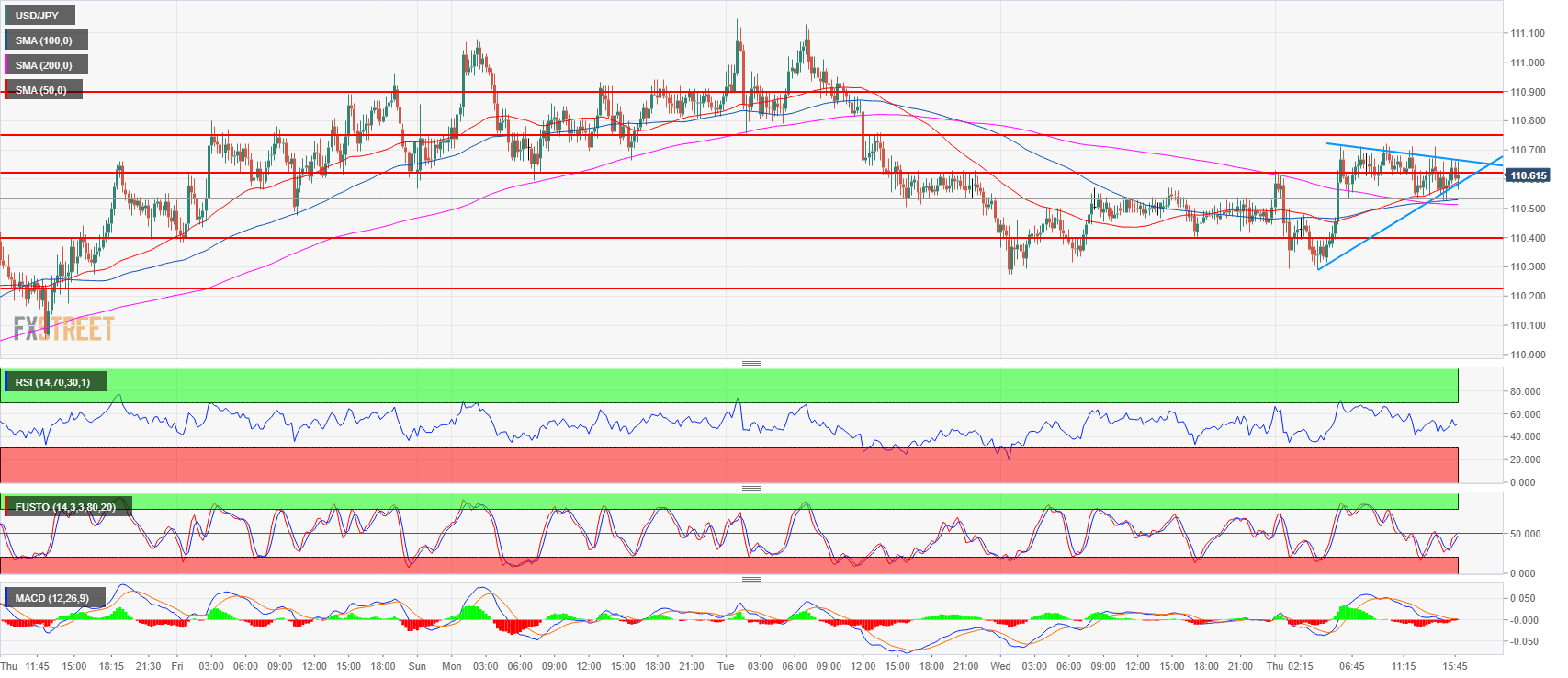

- USD/JPY is currently capped by the 110.75 level as the market is having a slight bullish bias as it is trading above the 200-period simple moving average (SMA).

Spot rate: 110.62

Relative change: 0.11%

High: 110.72

Low: 110.28

Trend: Neutral to Bullish above 110.21

Resistance 1: 110.62-75 supply level and June 21 high

Resistance 2: 110.90 June 15 swing high

Resistance 3: 111.39 May 21 swing high

Resistance 4: 112.05 February 2 low

Support 1: 110.40 supply/demand level

Support 2: 110.21 June 22 high

Support 3: 109.90-110.00 area supply level and figure

Support 4: 109.55 June 19 low

Support 5: 109.20 June 8 low