- USD/JPY nears 111.00 – the highest level since Jan. 23.

- The JPY calls continue to lose value.

The USD/JPY continues to rise, tracking the uptick in the US treasury yields.

As of writing, the pair is trading at 110.95 – the highest level since Jan. 23 and looks set to scale the 111.00 mark in a convincing manner.

JPY calls lose value

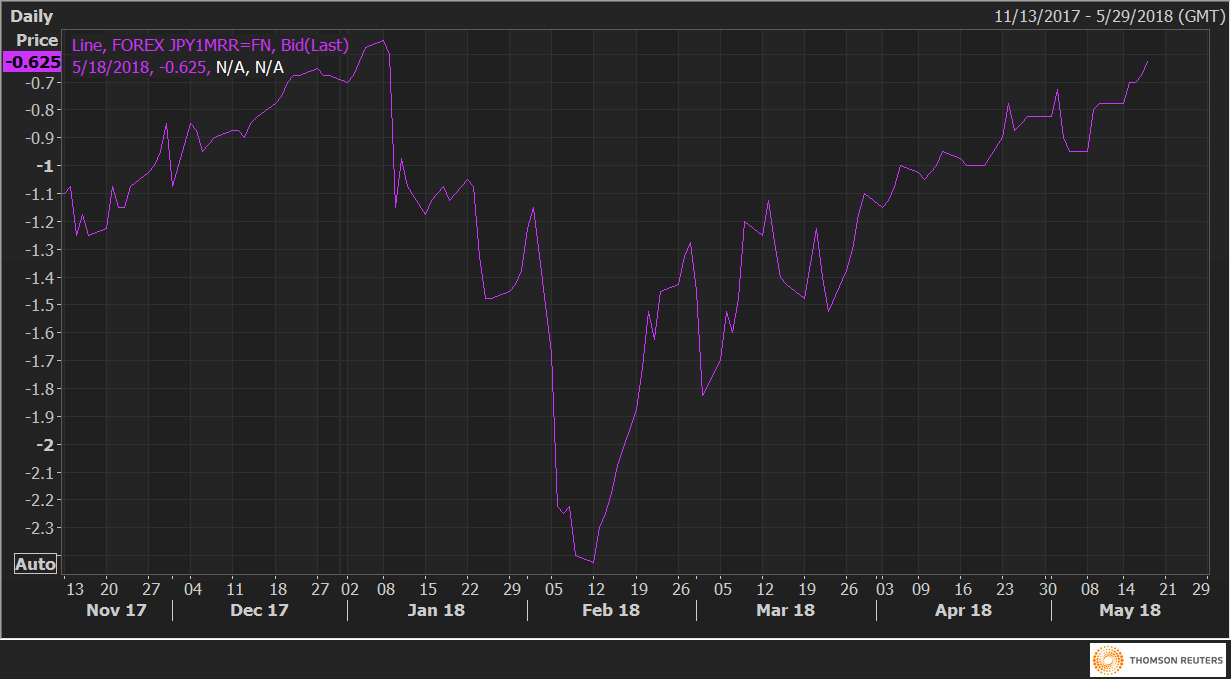

The one-month 25 delta risk reversals (JPY1MRR) rose to -0.625 – the highest level since January 9, representing falling implied volatility premium for JPY calls (bullish bets). Note, the risk reversals stood at -0.95 on May 8 and -2.425 on Feb. 12.

The rise in the risk reversals (drop in JPY call value) only adds credence to the USD/JPY rally.

JPY1MRR