- US retail sales rose while jobless claims fell, indicating still persistent inflation.

- The dollar also rose amid optimism over the US debt ceiling negotiations.

- Japan’s economy recovered and grew at a faster-than-expected rate in Q1.

The USD/JPY weekly forecast is bullish as dollar strength will likely continue amid hopes of a debt ceiling resolution.

Ups and downs of USD/JPY

USD/JPY had a bullish week as the dollar strengthened, pushing the pair to higher highs. The week was full of releases from the US and Japan that moved the pair. Important data from the US included retail sales and initial jobless claims, while Japan released GDP data.

–Are you interested to learn more about forex bonuses? Check our detailed guide-

US retail sales rose while jobless claims fell, indicating still persistent inflation. This revelation had investors scaling back their rate-cut bets, which boosted the dollar. The dollar also rose amid optimism over the US debt ceiling negotiations.

Japan’s economy recovered and grew at a faster-than-expected rate in Q1. However, there is still uncertainty about how soon the BOJ can reduce its stimulus.

Next week’s key events for USD/JPY

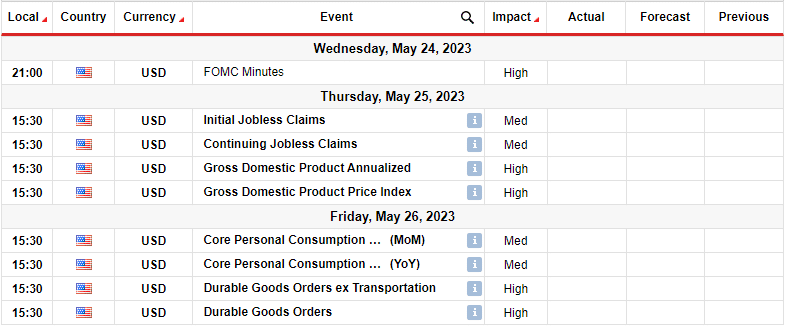

Investors will focus on US releases next week as there won’t be any key ones from Japan. The US will release many reports, but investor focus will be on the Fed meeting minutes, jobless claims, and the core PCE price index.

The FOMC minutes will show what went into the rate decision at the most recent Fed meeting. It might give more clues on the future of the Fed’s monetary policy. On the other hand, the jobless claims will show the state of the US labor market.

Finally, the core PCE price index, the Fed’s main inflation indicator, will come out on Friday. This will influence the market’s interest rate outlook.

USD/JPY weekly technical forecast: 139.00 breakout looms as bullish trend strengthens

The bullish bias in the daily chart for USD/JPY is strong because the price trades far above the 22-SMA. Additionally, the RSI trades closer to the overbought region, indicating solid bullish momentum.

–Are you interested to learn more about forex trading apps? Check our detailed guide-

Furthermore, the price broke above the 137.75 resistance level to make a higher high, strengthening the bullish bias.

The price is retesting the recently broken 137.75 level. We could see it bounce higher in the coming week to take out the 139.00 resistance level. At the same time, there may be a deeper pullback below 137.75 before the bullish trend continues.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.