Dollar/yen made a move on 110 but failed to break to higher ground. The pair eventually ended the busy week almost unchanged. Is this a necessary consolidation or the beginning of a downfall? The US inflation report stands out as the ultimate decision maker for the next moves of the pair as geopolitics slide to the backburner.

USD/JPY fundamental movers

Not so great NFP, not so great Fed

The Non-Farm Payrolls disappointed on both jobs, which advanced by 164K against near 200K expected, and wages, which increased by only 0.1% m/m and decelerated to 2.6%. The initial sell-off of the dollar was followed by a recovery, something that characterized earlier disappointments such as both ISM PMI figures and also the Fed decision.

As expected, Powell and co. left interest rates unchanged at 1.50% to 1.75% and are still on course to raise rates in June. However, the statement was not that hawkish. They talked about inflation as being a symmetric target, thus opening the door to tolerating higher levels of CPI rises. On the economy, they were also relatively cautious.

In Japan, it was a relatively quiet week with no substantial developments in the Korean peninsula, nor with PM Abe’s troubles at home. A high level US delegation flew to China to talk trade, but so far, no progress was made and talks continue. All these stories could make a comeback.

Inflation eyed

Thursday’s inflation report is key to the next moves of the US Dollar. After long months of sticking to the 1.8% level, core CPI finally jumped to 2.1% in March but is now expected to slide back below the 2% level. Any deviation from 1.9% that is expected will rock the dollar across the board. Monthly core CPI carries expectations for 0.2% once again.

Early in the week, Fed Chair Jerome Powell will speak and will also have a chance to influence markets. However, he may also refrain from talking about monetary policy in a speech that may focus on the past. Also watch out for US PPI as a warm up to CPI and last but not least, the University of Michigan’s Consumer Sentiment will be of interest.

See all the main events in the Forex Weekly Outlook

Key news updates for USD/JPY

[do action=”autoupdate” tag=”USDJPYUpdate”/]USD/JPY Technical Analysis

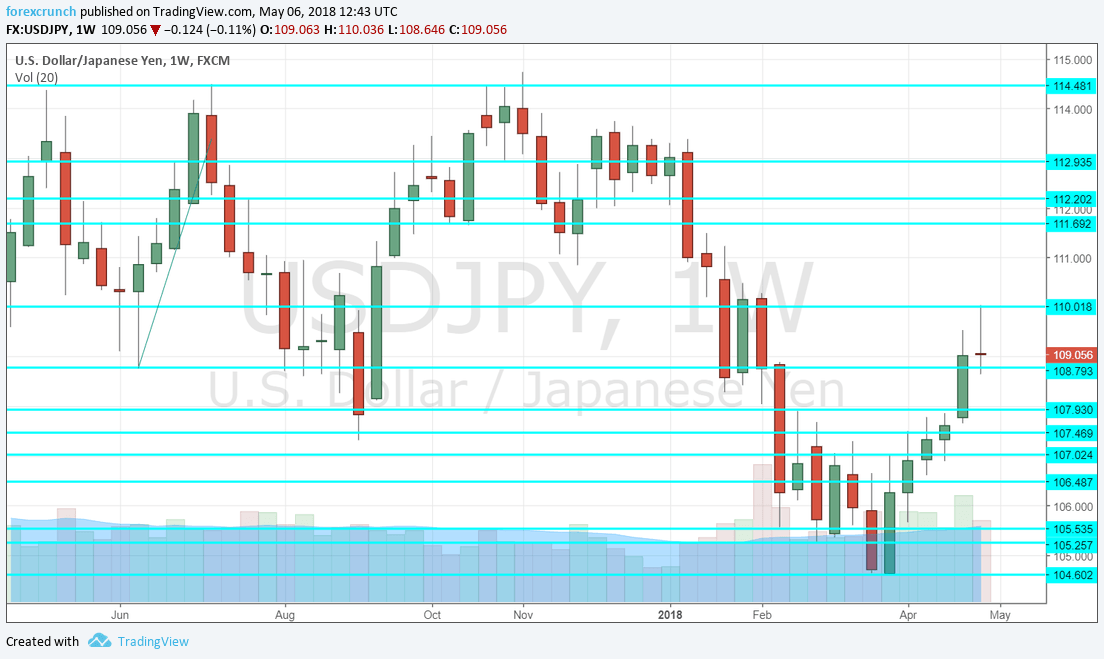

112.20 supported the pair back in December. It is followed by 111.50 that capped the pair in January.

Further down, 110.50 was a swing high in February. The round number of 110 serves as a psychological level. 109.50 held the pair back in late April.

109 was a pivotal line within the range. 108.30 was the low seen in late January. Even lower, we find 107.50 capped the pair in early April and is a strong line.

106.50 was a resistance line in mid-February. and then resistance in early March. 105.55 was the first swing low.

USD/JPY Daily Chart

USD/JPY Sentiment

I am bullish on USD/JPY

The pair had its time to consolidate and the uptrend can resume now. The Fed is still on course to raise rates and assuming no significant geopolitical deterioration happens, the pair can make another attempt on 110.

Our latest podcast is titled Is inflation rearing its ugly head? Oil is on fire

Further reading:

- EUR/USD forecast – for everything related to the euro.

- GBP/USD forecast – Pound/dollar projections

- AUD/USD forecast – analysis for the Aussie dollar.

- USD/CAD forecast – Canadian dollar predictions

Safe trading!