- US dollar rises against Latin American currencies, including the Mexican peso.

- USD/MXN points to the upside but needs to hold on top of 19.35.

The USD/MXN pair is rising for the second day in a row. It peaked at 19.40 and then pulled back to the 19.35 area. The Mexican peso failed to hold to gains after being affected by the reversal in Wall Street.

Equity prices in the US opened in positive ground but turned to the downside, ending the session in negative. The risk aversion tone weighed on the Mexican peso that it was likely also impacted by the decline in Latin American currencies. The debate on the trade agreement between the US, Canada and Mexico is expected to be debated soon at the House of Representatives and it is a risk event for the MXN.

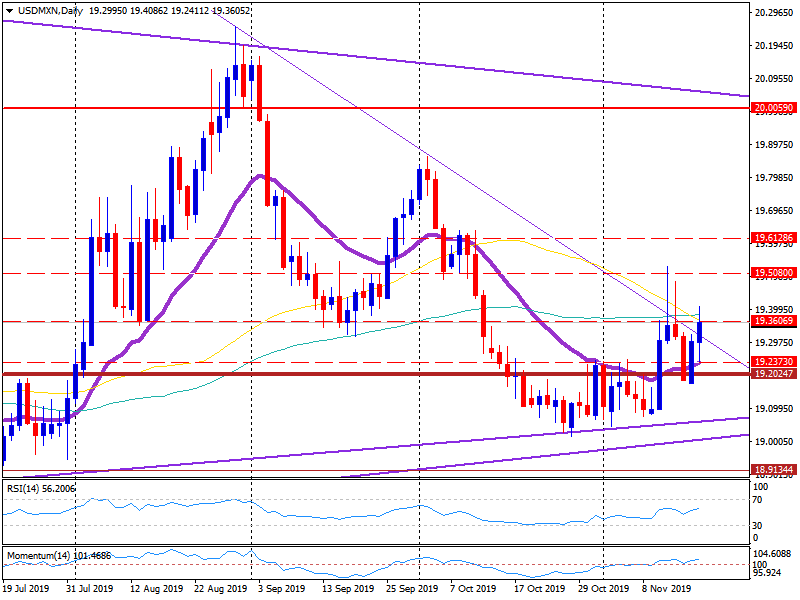

Technical outlook

The pair is about to post a daily close on top of a downtrend line that should signal more strength ahead but at the same time, it was unable to hold clearly on top of 19.35. If it manages to rise and hold above, it would target the 19.45/50 zone.

On the downside, a decline below 19.30 should suggest the US dollar is not ready to resume the rally. Below, the next support is seen at 19.20 that protects the critical support zone of 19.00/05.