- USD/MXN takes a U-turn from a two-week low.

- WTI fails to cheer OPEC+ output cut.

- Mexican net job losses in March surged the most in 25 years, the coronavirus crisis woes the economy.

USD/MXN recently bounced off two-week low, currently around 23.45, amid the Asian session on Monday. While the broad US dollar weakness could have been cited for the pair’s earlier weakness, recent declines of WTI, as well as rising coronavirus (COVID-19) fears, seem to trigger the pair’s recovery moves.

Despite initial drama from Mexican oil diplomats, the OPEC (Organization of the Petroleum Exporting Countries) and its allies including Russia, the US and Canada, mostly known as OPEC+, majors agreed to reduce output by 9.7 million barrels per day for May-June.

Even so, oil prices fail to cheer the deal as the resulted output cut is likely to consider lesser than earlier forecasts of 20 million barrels per day of reduction. It should be noted that the Mexican dollar relies heavily on oil moves as being the highest export earner.

As per Sunday’s news from Reuters, relying on the Mexican Health Ministry comments, Mexico reported 375 new cases of the coronavirus on Saturday, bringing the country’s total to 4,219 cases and 273 deaths. In a separate piece, Reuters also cited the death of the president of the board of Mexico’s main stock exchange, Jaime Ruiz Sacristan, who earlier tested positive for coronavirus.

Elsewhere, Bloomberg relies on the statement from the Mexican Social Security Institute, IMSS, to mention that the net job losses were the first for March since 2002 and the most since 1995.

In the case of the US, the world’s largest economy has now become the global epicenter, surpassing Italy, with more than 20,000 deaths and 530,000 cases of the pandemic.

With this, the market’s risk-tone remains under pressure and the US S&P 500 Futures portrays the moves with a 1.25% loss to 2,750 by the press time.

Moving on, traders will keep eyes on the virus updates for near-term direction due to the Easter Monday holidays in major countries.

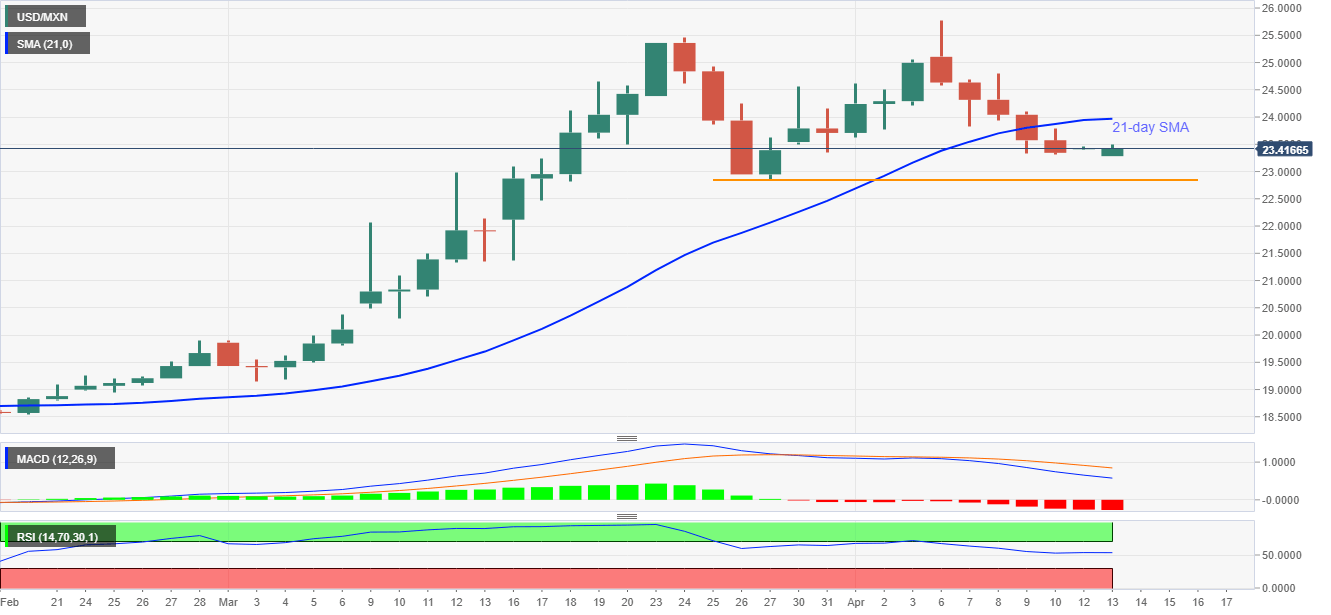

Mexican peso forecast chart

The pair’s sustained trading below 21-day SMA, currently around 24.00, keeps the bears hopeful to challenge March 27 low near 22.85.

Trend: Further weakness likely