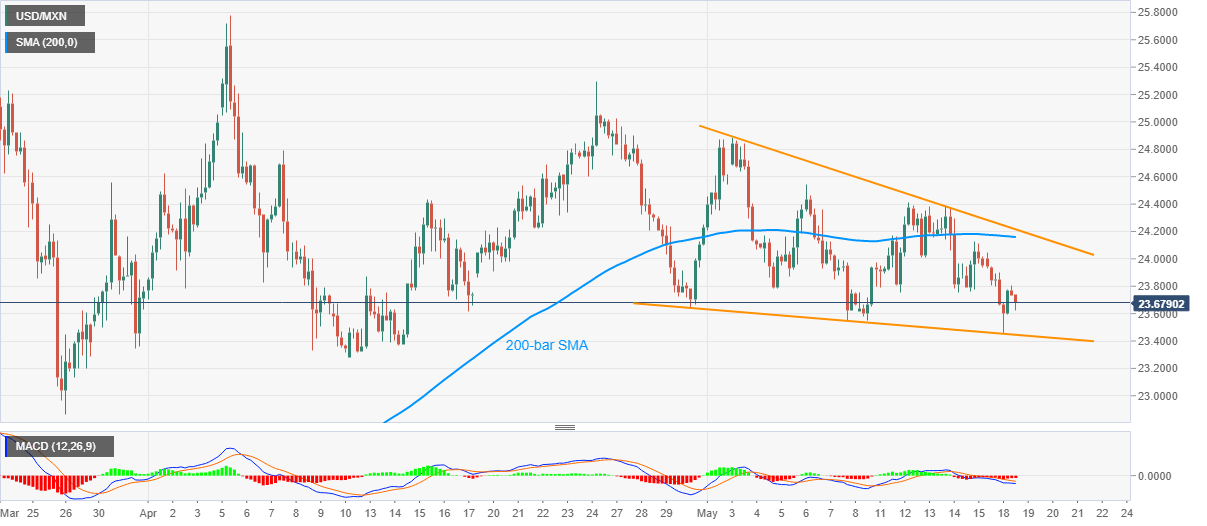

- USD/MXN keeps losses inside a short-term bullish technical formation.

- 200-bar SMA adds to upside barriers below the pattern’s resistance.

- The confirmation of bullish play can challenge late-April tops.

- April month low may lure the bears during further downside.

USD/MXN remains on the back foot while declining to 23.65, down 0.47% on a day, amid the initial hour of Tokyo trading on Tuesday.

In doing so, the pair nears the support line of the monthly falling wedge bullish technical formation, at 23.45 now.

Should bearish MACD drags the quote below 23.45, the bullish chart pattern gets negated, which in turn directs the sellers toward April low near 23.28.

During the pair’s further downside past-23.28, 23.00 and March 26 bottom around 22.86 will become the bears’ favorites.

On the contrary, 24.00 and 200-bar SMA level of 24.16 can check buyers during the pair’s recovery moves below the formation’s resistance line of 24.22.

It should, however, be noted that the pair’s sustained rise past-24.22 confirms the further upside towards the April month high of 25.78. However, April 24 high near 25.30 can offer an intermediate halt during the rise.

USD/MXN four-hour chart

Trend: Pullback expected