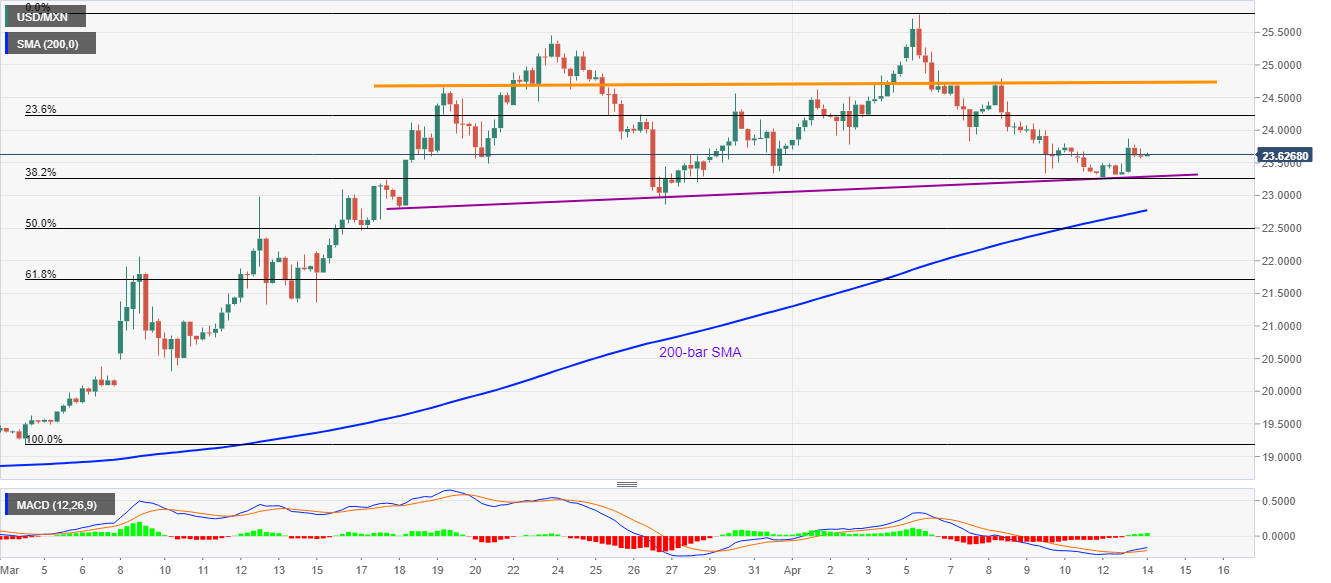

- USD/MXN struggles to extend the pullback from a four-week-old support line.

- 200-bar SMA offers an additional filter to further downside.

- Buyers may look for entry beyond 20-day-old horizontal resistance.

USD/MXN registers mild losses of 0.30% while taking rounds to 23.62 amid Tuesday’s Asian session. The pair recently bounced off a multi-year rising support line but fails to extend the recovery moves.

As a result, sellers will look for entry below the three-week-old rising trend line, near 23.30/28, while targeting a 200-bar SMA level of 22.77.

In a case where the USD/MXN prices remain heavy below 22.77, mid-March month low near 21.35 and 20.00 round-figure will be on the bears’ radar.

Meanwhile, an upside clearance of a horizontal area since March 19, between 24.65/75, is likely near-term strong resistance holding the gate for the pair’s run-up towards the monthly high near 25.80.

USD/MXN forecast chart

Trend: Pullback expected