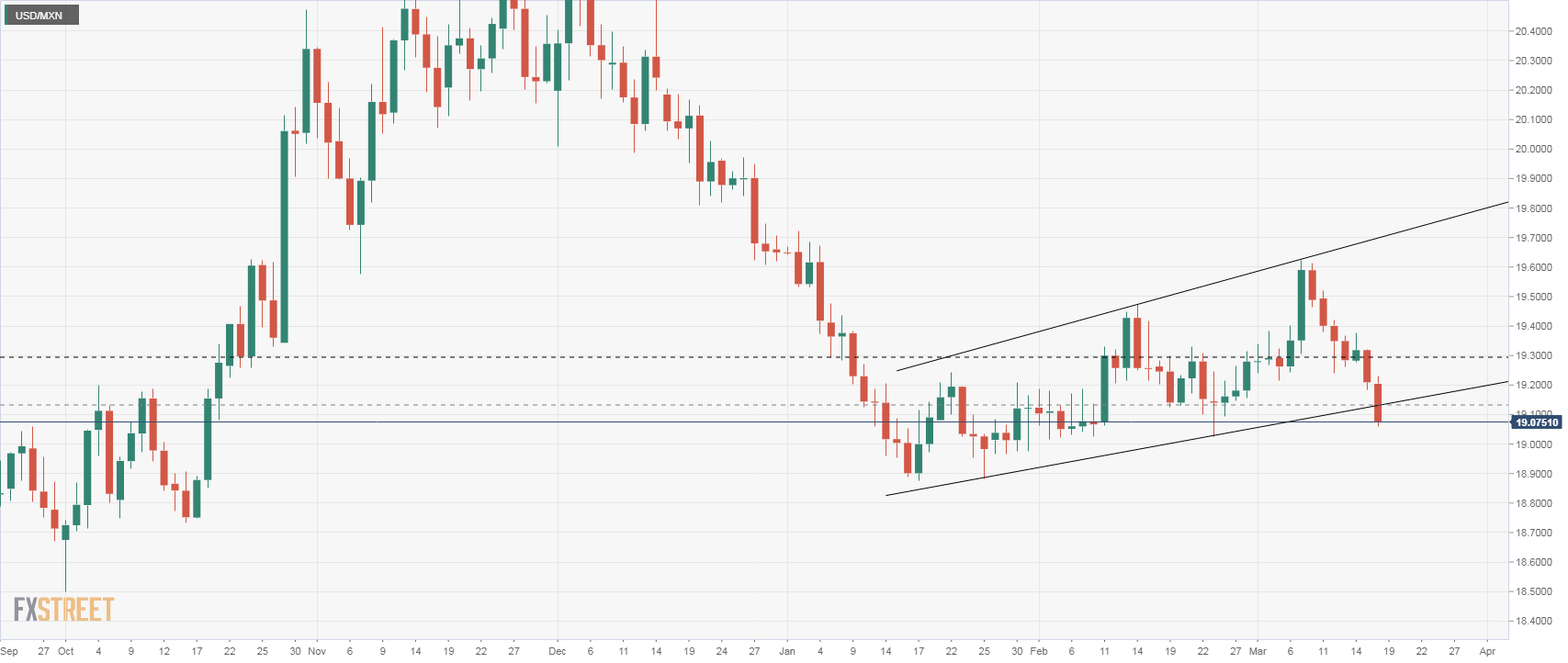

- The Mexican peso broke a key technical level and appears to be headed to further gains.

- On Friday, the USD/MXN dropped below 19.20, leaving it vulnerable to more losses in the short-term and today it is trading under an uptrend line that stands at 19.10. A confirmation under that area would point to a test of 19.00 with the odds favoring a break lower. The next zone to watch is 18.85/87, YTD lows.

- The US dollar needs to rise back above 19.20 to remove the intraday bearish bias, while under 19.30 the bearish outlook would remain intact.

USD/MXN Daily Chart

USD/MXN

Overview:

Today Last Price: 19.0702

Today Daily change: -0.1391 pips

Today Daily change %: -0.72%

Today Daily Open: 19.2093

Trends:

Daily SMA20: 19.2816

Daily SMA50: 19.1912

Daily SMA100: 19.6548

Daily SMA200: 19.4162

Levels:

Previous Daily High: 19.3201

Previous Daily Low: 19.1846

Previous Weekly High: 19.5204

Previous Weekly Low: 19.1846

Previous Monthly High: 19.4726

Previous Monthly Low: 19.0168

Daily Fibonacci 38.2%: 19.2363

Daily Fibonacci 61.8%: 19.2683

Daily Pivot Point S1: 19.1559

Daily Pivot Point S2: 19.1024

Daily Pivot Point S3: 19.0203

Daily Pivot Point R1: 19.2914

Daily Pivot Point R2: 19.3735

Daily Pivot Point R3: 19.427