The US dollar certainly received a boost from the growing prospects of a rate hike by the Federal Reserve in March. What does this mean going forward:

Here is their view, courtesy of eFXnews:

In Friday’s speech, Fed Chair Janet Yellen confirmed that the Fed is set to hike rates at the upcoming meeting ending on 15 March, unless the jobs report for February due on Friday is extremely weak. We probably need to see jobs growth below 100,000, a higher unemployment rate and no improvement in the weak earnings data in January before the FOMC members change their minds.

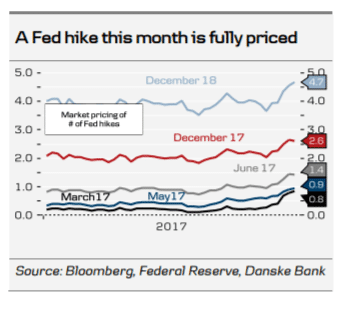

As we expect the jobs report for February to be good, we expect the Fed to deliver and change our Fed call to a March hike (previously June). Markets have priced in an 85% probability of a Fed hike at the upcoming meeting

…We raise our forecast and now think the Fed is set to hike three times this year in March, July and December (previously we expected two hikes with risk skewed towards a third hike), as the Fed seems less worried about inflation and has increased its weight on labour market and growth data. We stick to our view that the Fed is only set to hike once in H1 17 but now twice in H2 17 when we get more information about Trumponomics. By hiking at one of the small meetings in July, the Fed shows that it means that every meeting is ‘live’. Markets price in 2.5 hikes this year.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.