The US dollar is on the rise, with EUR/USD back at the 1.05 handle, USD/JPY around 113.50 and GBP/USD under 1.24. This was no quiet Asian session.

The main event during the session was President Trump’s highly anticipated speech to Congress, but the Federal Reserve stole the show. In particular, New York Fed President Bill Dudley, previously known as Dudley the Dove, made some hawkish comments and significantly raised the chances of a rate hike in March.

The chances for a rate hike were already on the rise, with Bloomberg’s WIRP function surpassing 50% earlier in the week and CME’s FedWatch creeping up as well. However, these were based on bullish notes from less senior Fed members.

Dudley is No. 3 at the Fed. In the past, his dovish comments pushed back expectations for a rate hike. Not this time. He said that the case for raising rates is “more compelling” and that “fairly soon” means the relatively near future. A usually cautious Dudley said that there is no question that the sentiment improved.

Williams of the San Francisco Fed said that current interest rates are “abnormally low” and that he does not see a need to wait or delay hiking rates. This is even more hawkish. For him, a hike in March is under “serious consideration”.

In addition, the bullish words from Dudley and his colleagues were picked up by notable market participants, most notably Goldman Sachs, which raised their own March expectations from 30% to 60%. They also cite Kaplan and Williams as well as recent data. They do caution their forecast on upcoming data, such as the Core PCE Price Index (the Fed’s favorite inflation figure), ISM data and also wages.

Trump’s speech

The President focused heavily on nationalism: America first, with programs to encourage buying American products while ditching foreign ones. However, the address was light on details. A trillion dollar infrastructure spending bill sounds like something he said on the campaign trail rather than a detailed plan.

His attack on immigration was not what markets wanted to hear. He did mention tax cuts, but once again, the details are still missing, 40 days into his presidency. In any case, tt was a political speech more than an economic one.

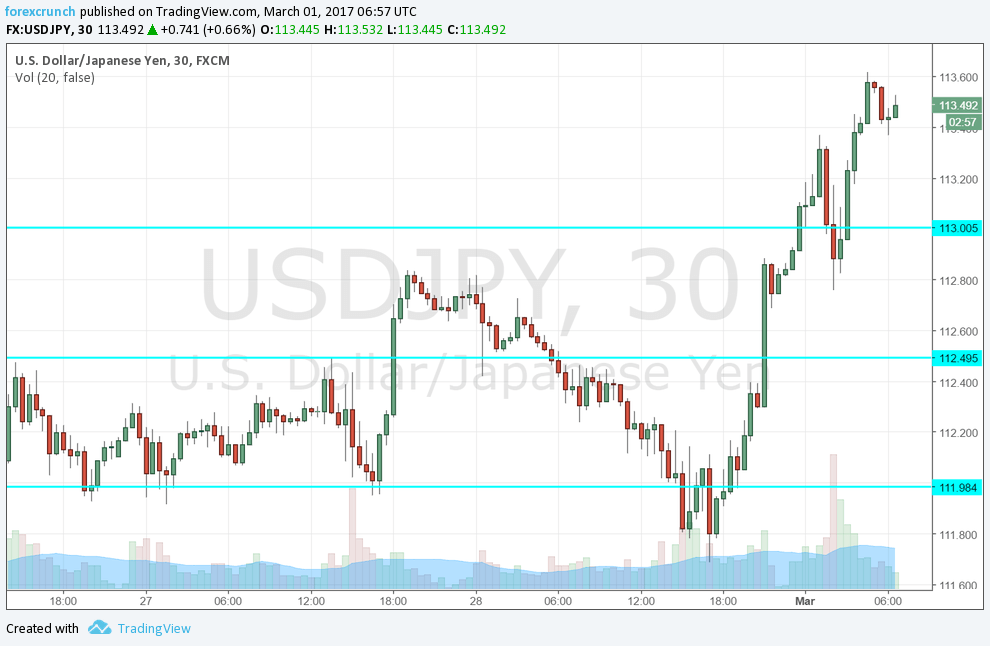

Here is how the move looks on the USD/JPY chart: