- The Russian currency loses momentum near 64.30 vs. the buck.

- Spot rebounds from recent 2019 lows around 63.60.

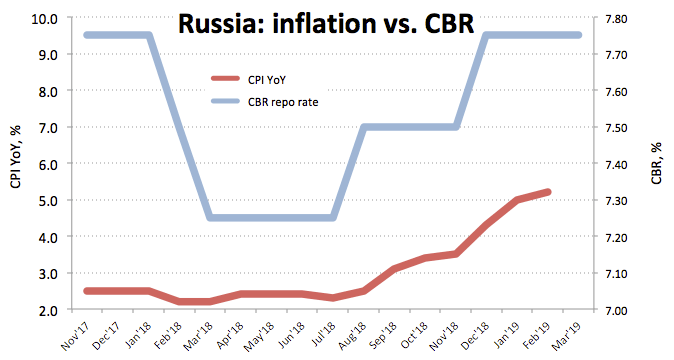

- CBR left the key rate unchanged at 7.75%.

The now softer tone in the Russian Ruble is now lifting USD/RUB to fresh 2-day highs around 64.30.

USD/RUB offered post CBR

RUB is losing the grip at the end of the week and is now pushing spot back above the critical 64.00 handle.

In addition, RUB accelerated its decline after the Russian central bank (CBR) left its key rate at 7.75%, matching the broad consensus.

The central bank noted that inflation keeps running below the bank’s expectations, although inflation expectations remain somewhat elevated according to the CBR. That said, the CBR has now revised lower its forecast for end-of-year inflation to 4.7%-5.2% (from 5.0%-5.5%) and sees consumer prices returning to the bank’s 4% target at some point in H1 2020.

Furthermore, the central bank opened the door for a potential rate cut later this year if domestic inflation, growth dynamic and external risks develop in line with the bank’s forecasts.

Later in the day, Governor E.Nabiullina will hold a press conference.

What to look for around RUB

The ongoing down trend in inflation plus the economy expanding above estimates could not only prevent the CBR from hiking rates further this year but it could also spark an easing cycle starting as early as this year, according to today’s statement at the bank’s meeting. In the meantime, the carry-trade remains supportive of RUB along with expected higher oil prices (despite RUB seems to have decoupled from oil dynamics as of late). On the negative side, the spectre of further sanctions on Russian citizens or the economy as well as geopolitical jitters carries the potential to undermine occasional upside momentum in RUB.

USD/RUB levels to watch

At the moment the pair is gaining 0.69% at 64.24 and a break above 64.66 (10-day SMA) would open the door to 65.34 (21-day SMA) and then 66.50 (high Mar.8). On the other hand, the next support is located at 63.61 (2019 low Mar.21) followed by 62.73 (200-week SMA) and finally 61.63 (monthly low Jul.10 2018).