The Fed’s dovish twist left many surprised and the team at CIBC thinks the market missed the true meaning.

Here is their view, courtesy of eFXnews:

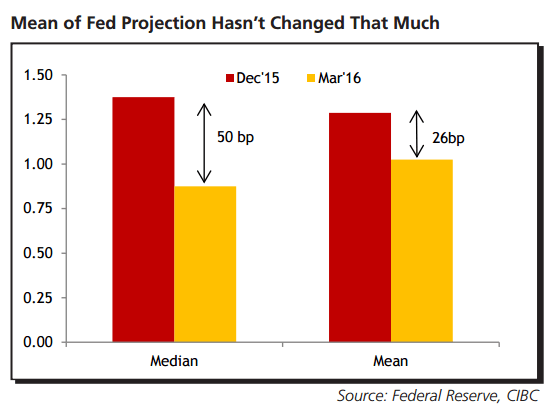

The Fed didn’t say much in its statement, so investors were left to zero in on the dot plots. And with the median going down from four hikes in 2016 to only two, markets decided that the Fed isn’t confident in its just started hiking cycle. Having systematically failed to deliver on past projections, why would this time be any different?

But the weakening in the US$ following the Fed may be an overreaction. Looking at the mean instead of the median forecasts shows a much less severe downgrade in projections. And all but one official still expects at least two hikes – more than markets are now pricing in.

Signs that the Fed isn’t quite as dovish as people now think should lead to a rebound in the greenback heading into what we still see as a likely June move.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.