The US government shut down late on Friday, after markets had already closed. The general notion was that politicians would eventually cut a deal, but that didn’t happen. Talks broke down and the government closed for business, well, except for the necessary functions. The impact was relatively small over the weekend but will be felt in a greater manner as the new workweek begins.

A surprising, negative, outcome, after markets closed should have brought the dollar down at the open. Well, this was the first reaction in early Asian trading, but the gaps were closed quite quickly.

- EUR/USD ended the week at 1.2215 and started off some 55 pips higher at 1.2271. The euro held onto its gains at first but has reached the starting point, trading at 1.2216 before moving up a few pips.

- GBP/USD closed the week at 1.3845 and kicked off the new week at 1.3894, also some 50 pips. And while cable hasn’t closed the gap, it already reached 1.3857, minimizing the gap.

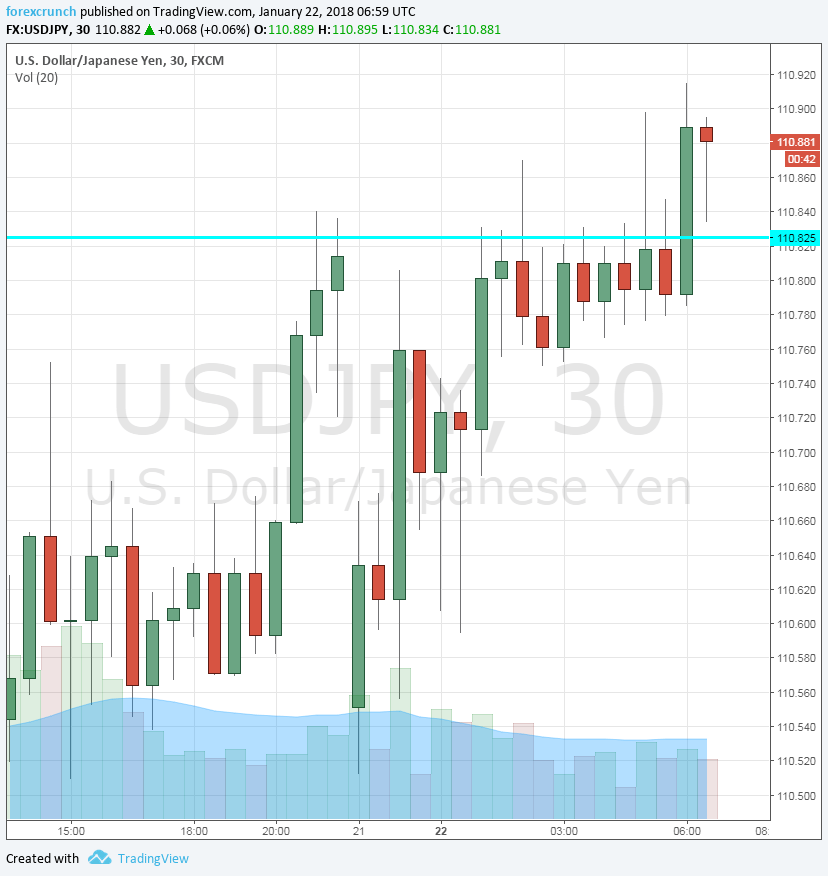

- USD/JPY opened some 30 pips lower, trading initially at 110.51 after closing at 110.81 on Friday. This gap was closed within two hours of trading.

Why is the dollar recovering?

One reason is a hope that this episode will end soon. Moderate Republicans and Democrats are trying to find a formula that would enable reopening the government, at least until mid-February, allowing time to find a solution on immigration.

Another reason is that the damage from such a shutdown isn’t huge. That is true assuming the closure doesn’t last for too long.

More: Death By Blockchain: Most common causes of security breaches