- USD/TRY adds to Monday’s gains and approaches 8.0000.

- No extraordinary announcements seen from the central bank.

- The 10.00 level emerges as the next target of relevance.

The Turkish lira remains well on the defensive in the first half of the week and now pushes USD/TRY to the vicinity of the 8.0000 mark.

USD/TRY points to further gains near-term

USD/TRY advances for the second session in a row on turnaround Tuesday, although it manages to keep business below the 8.0000 yardstick and Monday’s YTD highs near 8.3000 for the time being.

The persistent buying pressure in the greenback coupled with increasing outflows from the Turkish currency favours the likeliness of extra gains in the pair in the near/medium-term.

It is worth recalling that the lira fell off the cliff after President Erdogan sacked the former Governor of the Turkish central bank (CBRT) over the weekend.

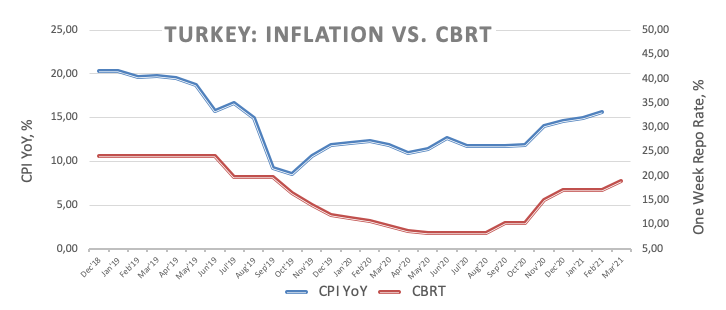

Erdogan replaced N.Agbal with S.Kavcioglu, the fourth central banker in the last five years. Kavcioglu, another advocate of the “higher rates equal higher inflation” church, faces a monumental task, which is restoring credibility and transparency to the CBRT, lowering the inflation and bringing in financial stability to the country.

The outlook for the lira is now expected to deteriorate at a fast pace, as the currency is seen eroding the previous bout of confidence from Agbal’s orthodox approach sooner than later.

What to look for around TRY

There is no change in the offered note surrounding the Turkish currency for the time being. The new CBRT Governor S.Kavcioglu is expected to reverse (wipe out) the shift to a market friendly approach of the monetary policy that was successfully implemented by former Governor N.Agbal back in November 2020. President Erdogan’s appointment of Kavcioglu demonstrated once again whose hand is rocking the monetary cradle in Turkey and will most likely be the prelude of the return to unorthodox/looser measures of monetary policy in combination with rapidly rising bets of a balance of payments crisis and a drain of FX reserves. Against this backdrop, it will surprise nobody to see spot trading around 10.00 in the months to come.

Key events in Turkey this week: March’s Capacity Utilization (Friday).

Eminent issues on the back boiler: Potential US/EU sanctions against Ankara. Government pressure on the CBRT vs. bank’s credibility/independence. Bouts of geopolitical concerns. Much-needed structural reforms. Growth outlook vs. progress of the coronavirus pandemic.

USD/TRY key levels

At the moment the pair is up 1.44% at 7.8805 and faces the next up barrier at 8.2881 (2021 high Mar.22) followed by 8.5777 (all-time high Nov.6 2020) and finally”¦ the moon?. On the downside, a drop below 7.1856 (monthly low Mar.19) would aim for 7.0000 (psychological level) and then 6.8923 (2021 low Feb.16).