- The Lira regains composure near 6.05 vs. the buck.

- Turkey Industrial Production contracted less than expected.

- US-China trade talks remain in centre stage.

Following last week’s 2019 tops near 6.85, USD/TRY has sparked a correction lower to the key 21-day SMA around 5.95, where it found some decent support for the time being.

USD/TRY focused on trade talks

TRY is gaining some traction and is reversing Monday’s drop amidst persistent concerns over the US-China trade effervescence while ignoring at the same time the pick up in tensions in the Middle East, where Iran, the US and Saudi Arabia are in centre stage.

On the domestic front, both the ‘Justice and Development Party’ (AKP) and the its main opposition, the ‘Republican People’s Party’ (CHP) have started their campaign to attract key undecided voters ahead of the municipal elections in Istanbul on June 23.

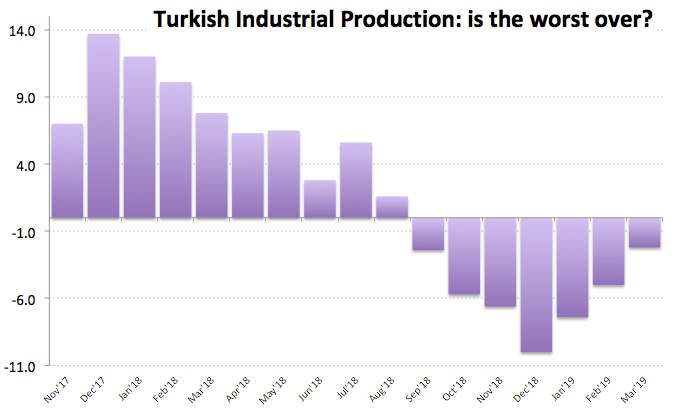

In the data space, Industrial Production contracted at an annualized 2.2% on a year to March, bettering estimates and improving from February’s 5.0% contraction.

What to look for around TRY

The Lira is seen under increasing selling pressure for the time being. The broader sentiment around the EM FX space should continue to influence on TRY via rising uncertainty around the US-China trade talks. In addition, friction between the AKP and its main opposition party ahead of the municipal elections in Istanbul is also emerging as another source for Lira volatility. Further out, potential US sanctions following the purchase of the Russian missile defence system keeps lingering over the country as well as sanctions over Iranian crude oil exports. Adding insult to injury, the independence and credibility of the CBRT should remain under the microscope against the omnipresent conflict between the Erdogan’s administration and bank’s authorities.

USD/TRY key levels

At the moment the pair is losing 0.24% at 6.0398 and a breach of 5.9472 (low May 9) would aim for 5.6460 (200-day SMA) and then 5.2918 (low Mar.26). On the flip side, the next hurdle emerges at 6.2457 (2019 high May 9) seconded by 6.8353 (high Aug. 30 2018) and finally 7.0831 (all time high Aug.13 2018).