- The pair moves to multi-week highs above 5.40.

- The CBRT left rates unchanged at today’s meeting.

- The CBRT keeps the tightening stance intact once again.

After an ephemeral drop to the vicinity of 5.36, USD/TRY has quickly rebounded to new multi-day highs beyond the critical 5.40 handle.

USD/TRY higher on CBRT

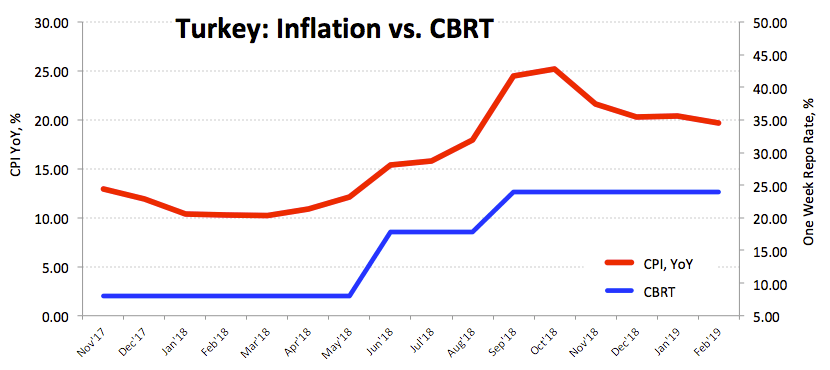

TRY is depreciating further today in the wake of the CBRT meeting, where the central bank kept the One-Week Repo Rate unchanged at 24.00%, matching the broad consensus.

The central bank kept the tightening cycle unchanged so far, always with the main focus on domestic inflation. Despite the economy still faces risks to price stability, the central bank noted that ‘developments in import prices and domestic demand conditions have led to some improvement in inflation indicators’.

It is worth recalling that latest inflation figures (Monday) showed consumer prices rose 0.16% MoM during February and 19.67% from a year earlier, both prints coming in below previous estimates.

The next risk event in Turkey will be the local (municipal) elections at the end of this month.

What to look for around TRY

TRY continues to lose ground albeit at a gradual pace since 2019 highs seen at the beginning of February (around 5.16), as market participants continue to adjust to the potential effects of the continuation of the Fed’s QT on the whole of the EM FX space. In the same line, the persistent deterioration in domestic fundamentals, the permanent conflict between Erdogan’s government and the central bank and potential geopolitical risks should continue to weigh on the currency for the time being. Somehow supporting the Lira, the CBRT still sees risks to the price stability, leaving the current scenario of tight monetary conditions to extend further in the longer term.

USD/TRY key levels

At the moment the pair is gaining 0.26% at 5.3968 facing the next hurdle at 5.4102 (high Mar.6) seconded by 5.5440 (high Jan.9) and finally 5.6371 (2019 high Jan.3). On the downside, a breach of 5.3581 (100-day SMA) would expose 5.3029 (21-day SMA) and then 5.2874 (low Feb.27).