- The pair came under some selling pressure following tops near 5.38.

- Weekly support emerges at Wednesday’s low around 5.32.

- The CBRT left the key rate unchanged at yesterday’s meeting.

The Turkish Lira is trading on the defensive on Thursday, prompting USD/TRY to regain some ground lost following yesterday’s pullback.

USD/TRY stays sidelined, gains capped at 5.60

The pair’s sharp pullback on Wednesday seems to have met strong support in the proximity of the 5.3200 handle so far, all framed within the broader consolidative scenario prevailing since November.

This consolidative theme looks like a kind of base-zone following the retracement from the all-time peaks seen during the last summer beyond 7.000 the figure.

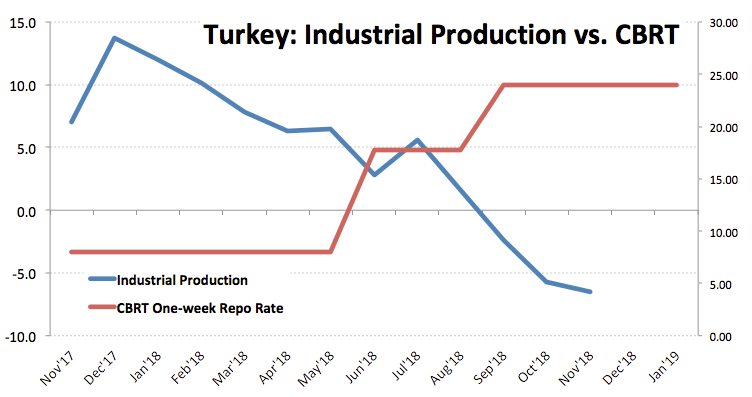

TRY has gathered extra steam yesterday after the CBRT left the One-Week Repo Rate unchanged at 24.00%, broadly in line with prior surveys. The central bank, however, delivered a somewhat hawkish message, allaying fears of a resumption of the easing cycle anytime soon.

The Lira is also deriving some weakness today from the softer tone in the barrel of European reference Brent crude, which is down around 1.5% just above the key $60.00 mark. Other drivers to look for around the Turkish currency should be on the geopolitical sphere, with the war in Syria in centre stage.

In the domestic calendar, Industrial Production in Turkey contracted 6.5% in November from a year earlier, the Quarterly 3-month Jobless Average ticked higher to 11.6% in October and the Budget Balance in December showed a TRY 18.10 billion deficit.

USD/TRY key levels

At the moment the pair is up 0.75% at 5.3712 and a breakout of 5.4096 (10-day SMA) would open the door to 5.5440 (high Jan.9) and finally 5.6371 (2019 high Jan.3). On the flip side, the next support aligns at 5.3217 (low Jan.16) seconded by 5.2265 (200-day SMA) and then 5.2028 (low Dec.19 2018).