- USD/TRY risk reversals drop to the lowest level in over eight months.

- The data indicates a falling demand for the bearish bets (put options) on TRY.

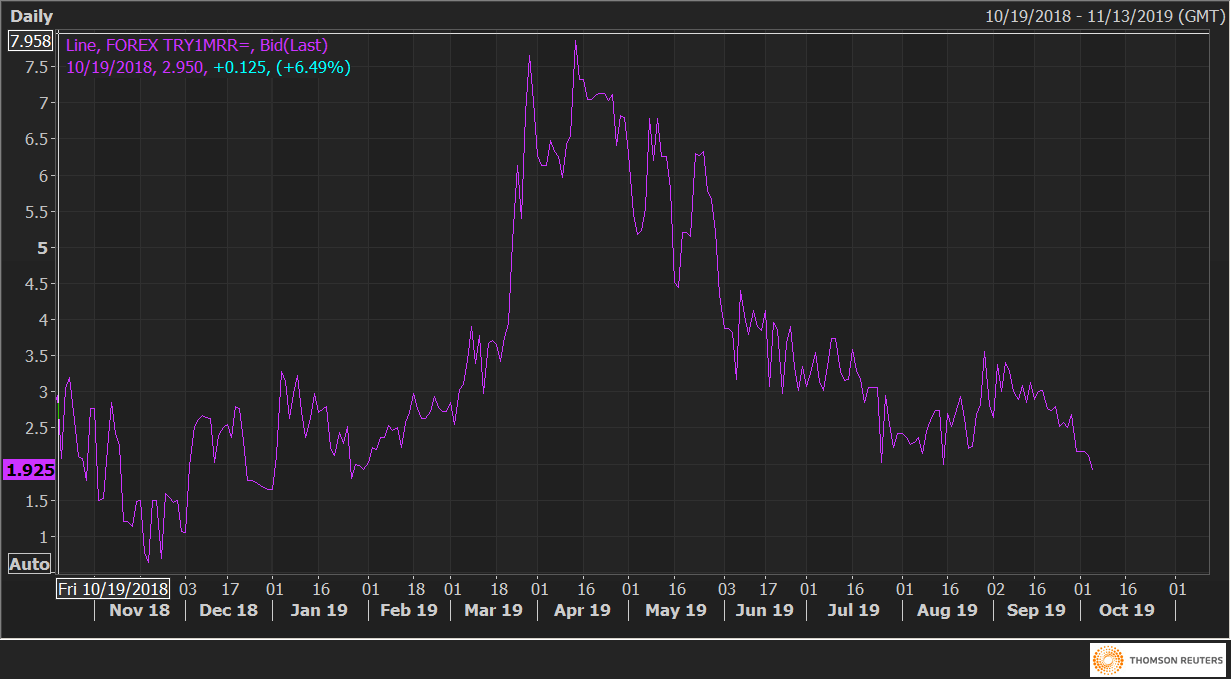

Risk reversals on USD/TRY (TRY1MRR), a gauge of calls to puts on Turkey’s currency, fell to the lowest level since Jan. 31 on Friday, indicating the investors are positioning for a rise in Lira (TRY).

The one-month risk reversals fell to 1.925, the lowest level in over eight months, having hit a high of 3.55 in August and 7.86 in April.

The slide represents a sharp drop in the demand or implied volatility premium for the TRY put options (bearish bets).

As of writing, the USD/TRY pair is trading at 5.7121, representing a 0.48% gain on the day.